The worldwide journey trade confirmed average development in Could 2025, with the Skift Journey Well being Index reaching 102, indicating 2% development year-on-year.

A deep dive into sector efficiency, nonetheless, reveals diverging traits between the 2 lodging sectors: trip leases, that are hovering, and accommodations, that are softening.

In response to the newest Skift Journey Well being Index report, trip leases are experiencing a surge, rising 12% relative to Could 2024, whereas accommodations witnessed a slowdown (2% year-on-year) within the face of rising financial uncertainties.

Skift Journey Well being Index Rating by Sector

| Area | Feb-25 | Mar-25 | Apr-25 | Could-25 |

|---|---|---|---|---|

| Airways | 103 | 105 | 105 | 102 |

| Motels | 100 | 105 | 103 | 98 |

| Trip leases | 113 | 108 | 113 | 112 |

| Automobile leases | 98 | 107 | 105 | 109 |

Trip Leases: The Star Performer

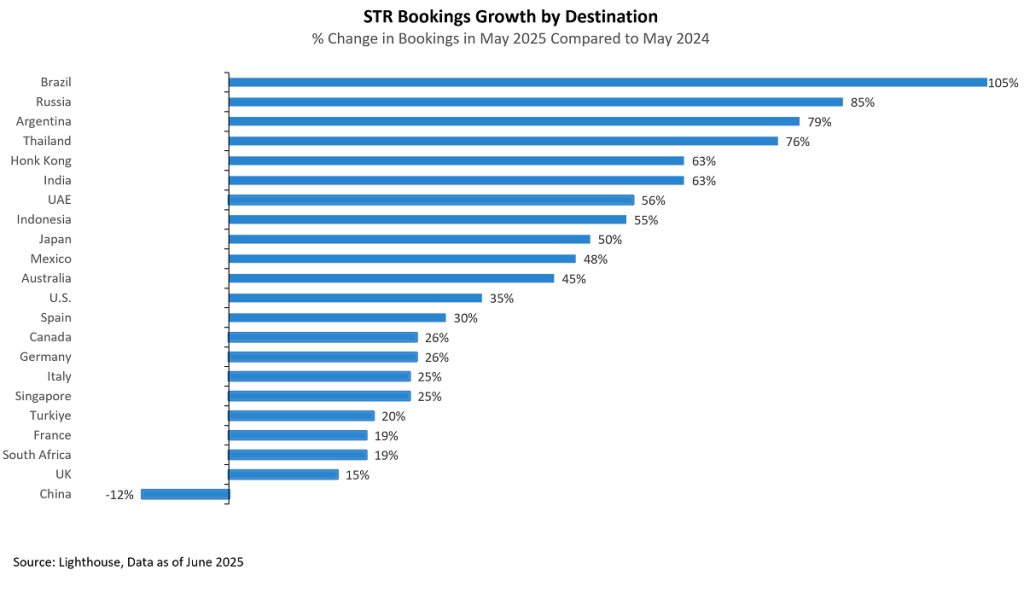

Brief-term leases emerged as the highest performer in Could, with its index rising 12% year-on-year. This robust development highlights continued urge for food for different lodging amongst vacationers. Brazil led with a robust 105% enhance in short-term rental bookings in Could.

Whereas international short-term rental occupancy dipped in the course of the month – probably attributable to provide development outpacing demand after April’s Easter vacation surge – the outlook for summer season stays robust.

AirDNA forecasts continued momentum for short-term leases within the U.S., projecting 3–4% RevPAR development from 2024 to 2026. The expansion is primarily pushed by a forecasted enhance in common day by day fee (or ADR).

U.S. Brief-Time period Rental Trade: Historic Efficiency and Forecasts

Yr-on-Yr Share Change

| Area | 2022 | 2023 | 2024E | 2025F | 2026F |

|---|---|---|---|---|---|

| Nights listed | 22% | 8% | 7% | 5% | 5% |

| Demand | 15% | 2% | 7% | 5% | 6% |

| Occupancy | -4% | -4% | 0% | 0% | 1% |

| ADR | 5% | -3% | 3% | 3% | 2% |

| RevPAR | -2% | -9% | 3% | 3% | 4% |

Supply: Reproduced from 2025 U.S. Brief-Time period Rental Outlook Report, AirDNA, knowledge as of June 2025.

Motels: Slight Softening

In distinction, the lodge sector declined by 2% in Could. New lodge bookings for the approaching months have slowed throughout the board, except Latin America, which noticed a 6% enhance. This broad slowdown is probably going attributable to a shortening of reserving home windows, a typical development in periods of financial uncertainty.

Key efficiency indicators for accommodations, equivalent to occupancy and ADR, introduced a blended image. Whereas they elevated in some areas, they declined in Europe (3% year-on-year) and North America (1% year-on-year).

Within the U.S., ADR fell by 4% and occupancy by 2%, suggesting accommodations could also be strategically reducing charges to stimulate demand.

This has led PwC to decrease its 2025 U.S. lodge efficiency forecast. The up to date projections anticipate that U.S. RevPAR will rise solely by 0.9% to $101, a discount from earlier estimates. ADR is now anticipated to extend by simply 0.8% to $160, with occupancy development remaining minimal at 63%.

PwC’s Quarterly U.S. Lodge Outlook

| Area | Q1 2025 | Q2 2025 | Q3 2025 | This autumn 2025 | Full Yr 2025 |

|---|---|---|---|---|---|

| Occupancy | 58% | 66% | 67% | 61% | 63% |

| Y-o-Y development | 0.40% | -0.90% | 0.30% | 0.60% | 0.10% |

| ADR | $158 | $160 | $162 | $161 | $160 |

| Y-o-Y development | 1.90% | -0.30% | 0.80% | 1.10% | 0.80% |

| RevPAR | $92 | $106 | $109 | $97 | $101 |

| Y-o-Y development | 2.20% | -1.20% | 1.10% | 1.80% | 0.90% |

Supply: STR; U.S. Bureau of Financial Evaluation; U.S. Bureau of Labor Statistics; S&P International (forecast launched Could 2025); CoStar; PwC. Knowledge as of June 2025.

PwC attributes this revision to financial uncertainty, geopolitical tensions, and a smooth second quarter this yr. Whereas a rebound is anticipated for the second half of 2025 as financial circumstances stabilize, the fast outlook stays cautious.

The Skift Journey Well being Index is a real-time measure of the efficiency of the journey trade at giant, and the core verticals inside it, which supplies the journey trade with a robust instrument for strategic planning. We have now been monitoring journey for 22 of the most important international economies since 2020, with constant month-to-month knowledge inputs throughout 88 indicators which might be aggregated to cowl classes equivalent to aviation, accommodations, short-term leases, and automobile leases.

Entry the Skift Journey Well being Index: Could 2025 Highlights for an in-depth evaluation and the Journey Well being Index dashboard to visualise the information.

The journey trade’s prime occasion returns this fall.

September 16-18, 2025 – NEW YORK CITY