After the market closes on Wednesday, Nvidia will report earnings for the primary quarter of its fiscal yr 2026, which ended on April 27.

Whereas many within the business are possible keen to listen to how the current whiplash surrounding U.S. chip export controls will impression Nvidia’s worldwide chip enterprise and future steering, not everybody thinks that’s a very powerful piece of Nvidia’s outcomes to concentrate to.

Kevin Cook dinner, a senior fairness strategist at Zacks Funding Analysis who has adopted Nvidia for a decade, informed TechCrunch he believes the corporate’s rollout its new GB200 NVL72 {hardware} — a single-rack exascale laptop that began delivery in February — is a way more essential space for shareholders to give attention to.

These GB200 NVL72 machines embody 72 GPUs and value round $3 million. Cook dinner mentioned that, regardless of robust demand and excessive expectations heading into this yr, the chaos round DeepSeek in late January sparked many analysts to halve their supply estimates for the unit.

Cook dinner added that, since that is the primary quarter the corporate has shipped the machine, there isn’t but a transparent indicator of how issues are going.

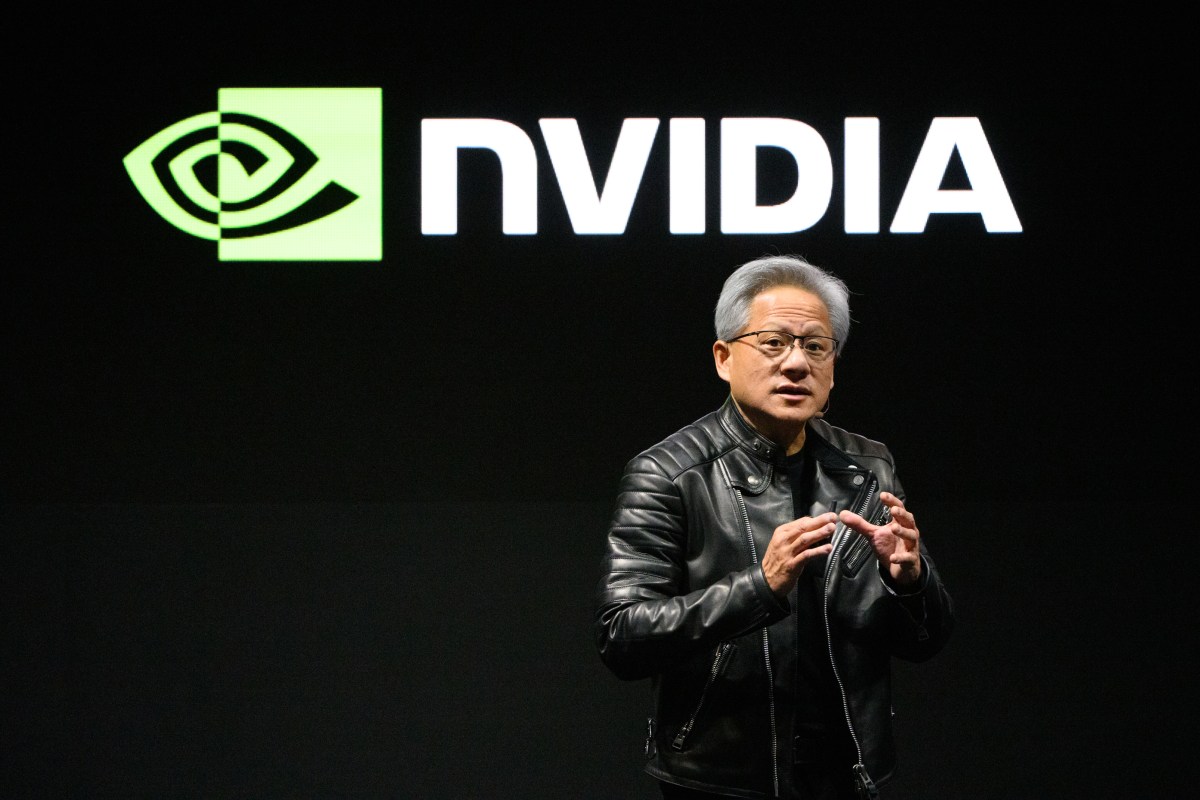

“If Jensen [Huang] says we’re going to ship 10,000 items in Q2, the road will probably be very impressed,” Cook dinner mentioned. “That’s a giant doable quantity; 10,000 is $30 billion on a $3 million product. I believe they will do lower than 5,000.”

Cook dinner added that these outcomes will begin to paint an image of enterprise urge for food for the most recent AI tech. Will corporations improve their AI {hardware} every time a brand new system comes out, much like how customers improve to the most recent iPhone annually? Cook dinner isn’t certain. Whether or not or not enterprises will undertake that habits may have a major impression on Nvidia down the road.

There will probably be fast results on Nvidia’s inventory based mostly on what the corporate says relating to U.S. export controls, Cook dinner predicted. However he doesn’t assume it is going to impression Nvidia’s valuation or inventory value long run in the identical approach that demand for the GB200 NVL72 may.

Nvidia’s inventory value has confirmed it could possibly recuperate from short-term market reactions, he added.

“We mainly had a flash crash, and it’s proper again up,” Cook dinner mentioned relating to Nvidia’s inventory value after the chip export restrictions had been introduced. “That’s distinctive to Nvidia. A number of corporations are going to have hiccups, however Nvidia has the largest moat. They’ve probably the most resilience to any of this. It’s such an irony that they may have this problem with China — whether or not or not they will promote — and it mainly will get shrugged off, proper?”

Even when chip export restrictions on China stay or turn into extra stringent, Cook dinner argued that Nvidia isn’t struggling to seek out prospects elsewhere. The corporate presently sells to all the main hyperscalers and can possible proceed to see robust demand for its AI chips. He added that the current bulletins relating to Stargate’s new undertaking within the Center East will possible be one other win for the corporate.

For Cook dinner, his steering actually comes all the way down to these GB200 NVL72 items.

“So long as we hear that deliveries are anticipated to be regular to distinctive, then no matter fluctuations on this quarter’s income, I believe, are going to be placed on the again burner as a result of the wind is of their sails for the remainder of the yr,” Cook dinner mentioned.