For a very long time, Misty Castaneda had horrible credit score. Despite the fact that she had medical insurance, the hair stylist from Colorado owed a hospital round $20,000 for a $200,000 open-heart surgical procedure in 2010 that had been essential to preserve her alive, she says.

Castaneda’s credit score was so dangerous that she stayed in a nasty relationship for greater than a decade, she says, as a result of she knew that with out her husband’s credit score rating, she wouldn’t have the ability to lease an house, purchase a automotive, or take out a bank card.

So when she just lately heard that the Shopper Monetary Safety Bureau (CFPB) had finalized a rule that may preserve medical debt off private credit score studies, she knew she needed to advocate on behalf of it. “It could simply open the doorways for thus many individuals like me,” says Castaneda, now 47 and divorced.

Though the rule preserving medical debt off credit score studies was finalized on Jan. 7, it could be on the chopping block as Elon Musk’s Division of Authorities Effectivity (DOGE) turns its sights to the CFPB. It’s not clear what powers the bureau will retain after Musk and his allies within the Trump Administration are by means of with it.

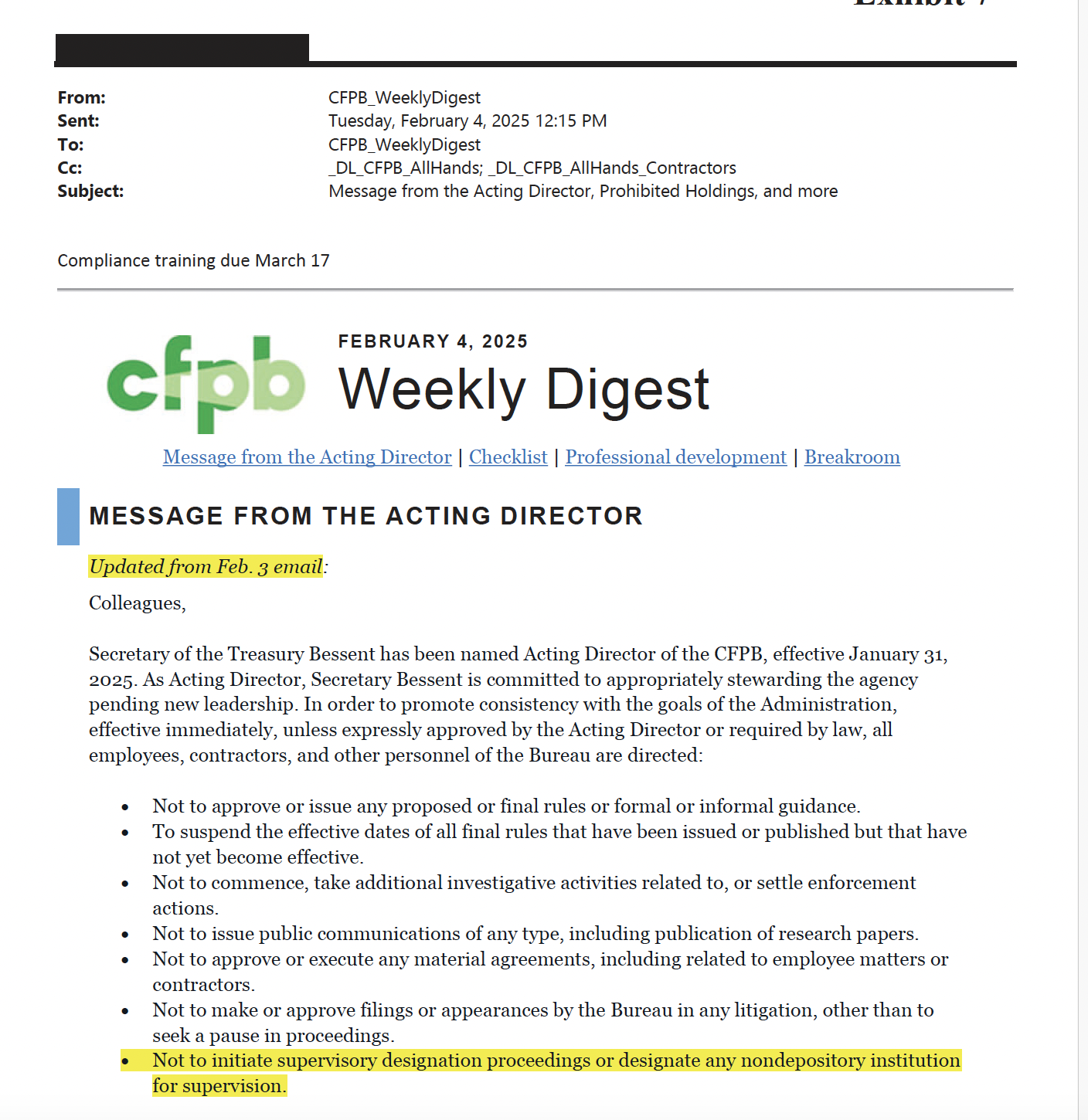

Trump has fired the CFPB’s director. Its appearing alternative, Workplace of Administration and Funds director Russell Vought, ordered all staff to cease work earlier this week, successfully suspending a lot of the bureau’s bread-and-butter actions. In an electronic mail, staff have been instructed to not approve or problem guidelines or steering and that they need to droop the efficient date of guidelines that had not but change into efficient, which incorporates the medical debt rule. Staff have been additionally instructed to stop any pending investigations and never problem any public communications of any kind. Vought stated on X on Feb. 8 that he could be notifying the Federal Reserve that the CFPB wouldn’t be taking its subsequent funding draw “as a result of it isn’t ‘moderately vital’ to hold out its duties.”

“CFPB RIP,” Musk wrote on X on Feb. 7.

It doesn’t appear to be the bureau goes away completely. On Feb. 12, President Trump reportedly nominated FDIC board member Jonathan McKernan to be director of the CFPB. However the Administration’s strikes are an enormous blow to shoppers, advocates say, and can depart holes in enforcement and regulation that would enable firms to reap the benefits of shoppers.

“The CFPB was established to take the aspect of extraordinary folks when Wall Avenue banks and large companies rip you off, once they tank your credit score report, once they push you into foreclosures,” says Lauren Saunders, affiliate director on the Nationwide Shopper Regulation Heart, a nonprofit that works on behalf of low-income shoppers. “Eliminating the CFPB will simply let Wall Avenue banks and company predators run amok.”

The White Home and DOGE didn’t reply to requests for remark.

What the CFPB does

The CFPB, which was created in 2010 within the wake of the monetary disaster, has three key assignments: it supervises banks and monetary establishments, writes guidelines that defend shoppers, and enforces the regulation. However there are different capabilities it performs that no different company can or would do if it have been eradicated, shopper advocates say.

The CFPB employs financial institution supervisors across the U.S., who go into monetary establishments periodically to verify books and forestall issues from occurring. It enforces 18 shopper monetary legal guidelines that Congress transferred to the company when it handed the Dodd-Frank Act, which established the bureau. It runs a criticism database, to which shoppers can submit studies of issues with sure firms. The company has acquired almost 7 million complaints from shoppers since Dec. 2024.

The CFP additionally prosecutes firms that it says fail to guard shoppers. In December, it filed a lawsuit towards the operator of Zelle and three of the nation’s largest banks for allegedly failing to safeguard shoppers from fraud. In January, it sued the credit score reporting company Experian for allegedly failing to analyze shopper disputes.

Maybe most significantly, the CFPB writes guidelines to assist shoppers. It just lately finalized a rule that may cap overdraft charges from banks, which the bureau stated would add as much as $5 billion in overdraft charge financial savings for shoppers. In January it finalized the rule that may take away medical debt from folks’s credit score studies, which it stated would take away $49 billion in medical payments from about 15 million People’ credit score studies. These guidelines are the product of months or generally years of on-the-record dialogue, to which anyone can submit feedback and attempt to sway regulators.

Learn Extra: This is The place China’s Retaliatory Tariffs On the U.S. May Hit Hardest.

“They’ve actually achieved rather a lot within the final six months, and plenty of of these accomplishments are being contested,” says Adam Rust, director of monetary companies on the Shopper Federation of America, a nonprofit affiliation of almost 250 pro-consumer teams.

It’s attainable the Trump Administration will attempt to transfer the obligations of the CFPB to a different company in its efforts to chop authorities spending. In a November publish on X, Musk wrote, “delete CFPB. There are too many duplicative regulatory businesses.”

However the CFPB was created exactly as a result of the outdated system didn’t work, says Julie Margetta Morgan, the affiliate director of analysis, monitoring, and laws on the CFPB within the Biden Administration. “Lots of the obligations that CFPB had,” she provides, “got here from the truth that these different businesses weren’t adequately defending shoppers.”

How DOGE may neutralize the CFPB

A few of the shoppers who is perhaps first affected by the Trump Administration’s strikes to restrict the CFPB’s energy are these like Castaneda, who’ve medical money owed ruining their credit score scores, or those that say that banks have charged them an excessive amount of on overdraft charges. That’s as a result of the principles just lately finalized by the CFPB are dealing with lawsuits from commerce associations that the company, below new management, could not defend towards, says Rust.

As an alternative of preventing the fits, the CFPB has as a substitute requested for a pause within the proceedings and has reportedly instructed its attorneys to not make appearances within the issues. The efficient date of the ultimate rule on medical debt has now been postponed from March 7 to June 15. However the CFPB may drop its protection of the case earlier than then. On Feb. 12, a bunch of nonprofit organizations filed a movement to intervene within the medical debt case in order that they might proceed to defend the rule.

Even some shoppers who assist DOGE’s cost-cutting makes an attempt are skeptical that the medical debt rule ought to go. Gloria Austin, a 67-year-old Chicago resident, says her credit score rating was hit by medical payments from when she contracted shingles—twice—in 2020, when she didn’t have medical insurance. Austin helps efforts to chop again authorities spending, and says she believes there’s a big quantity of fraud and waste that ought to be eradicated. She’s struggling below the burden of inflation and hopes that cost-cutting in authorities may reduce her bills and taxes.

Learn Extra: How Trump’s Tariffs May Have an effect on Shoppers.

However she additionally says the CFPB’s rule on medical debt would assist shoppers like her who’re saddled with payments they’ll’t keep away from. “It was both preserve the lights on and purchase groceries or pay my medical payments,” she says. Collectors have continued to hound Austin, she says. When she had to purchase a automotive, the one mortgage she may get had an rate of interest close to 30%. “No medical debt ought to seem on a credit score report,” she says. “Individuals are struggling sufficient already.”

Usually, shopper advocates say they count on the brand new Administration to take a a lot much less aggressive method to holding firms accountable. It may attempt to drop lawsuits towards firms like Experian, or cease on the lookout for new enforcement efforts to convey. “I don’t have plenty of optimism that the CFPB goes to proceed to prosecute enforcement actions,” says Saunders, of the NCLC.

Already, guests to the CFPB’s web site, consumerfinance.gov, are greeted with a brand new error message: “404: Web page not discovered.” An electronic mail from TIME to the CFPB’s press workplace was not returned.

Not the primary assault on the CFPB

The CFPB has been below hearth earlier than. It was first envisioned by now-Sen. Elizabeth Warren, then a professor at Harvard, and created after President Obama proposed a monetary company to concentrate on shopper safety within the wake of banks’ position within the monetary disaster.

Many Republicans opposed the creation of the bureau, insisting it had burdensome laws that may hamper shoppers’ potential to entry credit score. When the CFPB opened its doorways in 2011, it didn’t have a director as a result of the U.S. Senate wouldn’t affirm President Obama’s appointee. (President Obama used a recess appointment to put in Richard Cordray because the company’s chief.) Some Republicans have been attempting to eliminate the company ever since. In 2015, Sen. Ted Cruz launched a invoice to abolish the CFPB.

One of many greatest challenges to the company got here in a sequence of lawsuits opposing its statutory authority and funding construction that finally reached the Supreme Court docket. The CFPB emerged from the challenges intact, with one exception. In 2020, the Supreme Court docket dominated that the CFPB’s director could possibly be fired for trigger. That allowed Trump to eliminate former director Rohit Chopra on Feb. 1.

In 2024, the Supreme Court docket upheld the CFPB’s funding construction, saying it may draw cash from the earnings of the Federal Reserve. However Vought seems disinclined to take action. “This spigot, lengthy contributing to the CFPB’s unaccountability,” he wrote on X, “is now being turned off.”