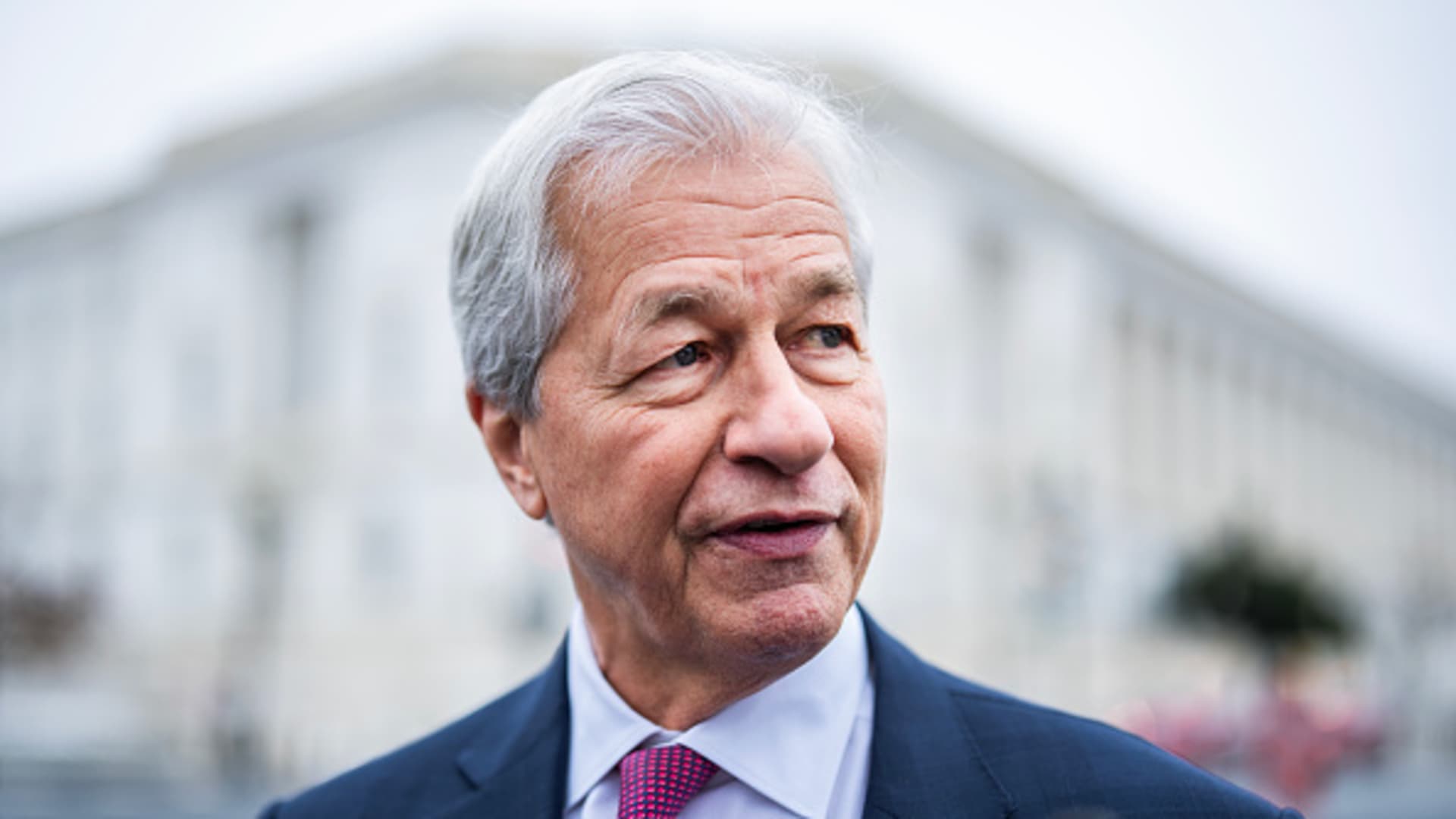

Jamie Dimon, CEO of JPMorgan Chase, leaves the U.S. Capitol after a gathering with Republican members of the Senate Banking, Housing and City Affairs Committee on the difficulty of debanking on Thursday, February 13, 2025.

Tom Williams | Cq-roll Name, Inc. | Getty Photographs

For years, American monetary corporations have fought the Shopper Monetary Safety Bureau — the chief U.S. shopper finance watchdog — within the courts and media, portraying the company as illegitimate and as unfairly concentrating on business gamers.

Now, with the CFPB on life assist after the Trump administration issued a stop-work order and shuttered its headquarters, the company finds itself with an unlikely ally: the identical banks that reliably complained about its guidelines and enforcement actions below former director Rohit Chopra.

That is as a result of if the Trump administration succeeds in lowering the CFPB to a shell of its former self, banks would discover themselves competing straight with non-bank monetary gamers, from large tech and fintech companies to mortgage, auto and payday lenders, that get pleasure from far much less federal scrutiny than FDIC-backed establishments.

“The CFPB is the one federal company that supervises non-depository establishments, so that will go away,” mentioned David Silberman, a veteran banking legal professional who lectures at Yale Regulation Faculty. “Fee apps like PayPal, Stripe, Money App, these types of issues, they’d get near a free experience on the federal degree.”

The shift might wind the clock again to a pre-2008 atmosphere, the place it was largely left to state officers to stop customers from being ripped off by non-bank suppliers. The CFPB was created within the aftermath of the 2008 monetary disaster that was attributable to irresponsible lending.

However since then, digital gamers have made vital inroads by providing banking providers by way of cell phone apps. Fintechs led by PayPal and Chime had roughly as many new accounts final 12 months as all massive and regional banks mixed, in line with information from Cornerstone Advisors.

“When you’re the large banks, you definitely do not desire a world during which the non-banks have a lot larger levels of freedom and far much less regulatory oversight than the banks do,” Silberman mentioned.

Maintain the exams

The CFPB and its workers are in limbo after performing Director Russell Vought took over final month, issuing a flurry of directives to the company’s then 1,700 staffers. Working with operatives from Elon Musk’s Division of Authorities Effectivity, Vought rapidly laid off about 200 staff, reportedly took steps to finish the company’s constructing lease and canceled reams of contracts required for legally-mandated duties.

In inner emails launched Friday, CFPB Chief Working Officer Adam Martinez detailed plans to take away roughly 800 supervision and enforcement staff.

Senior executives on the CFPB shared plans for extra layoffs that would depart the company with simply 5 workers, CNBC has reported. That might kneecap the company’s potential to hold out its supervision and enforcement duties.

That seems to transcend what even the Shopper Bankers Affiliation, a frequent CFPB critic, would need. The CBA, which represents the nation’s largest retail banks, has sued the CFPB prior to now 12 months to scuttle guidelines limiting overdraft and bank card late charges. Extra lately, it famous the CFPB’s function in protecting a degree enjoying area amongst market individuals.

“We consider that new management understands the necessity for examinations for giant banks to proceed, given the intersections with prudential regulatory examinations,” mentioned Lindsey Johnson, president of the CBA, in an announcement offered to CNBC. “Importantly, the CFPB is the only real examiner of non-bank monetary establishments.”

Vought’s plans to hobble the company had been halted by a federal choose, who’s now contemplating the deserves of a lawsuit introduced by a CFPB union asking for a preliminary injunction.

A listening to the place Martinez is scheduled to testify is ready for Monday.

‘Good luck’

Within the meantime, financial institution executives have gone from antagonists of the CFPB to amongst these involved it would disappear.

At a late October bankers conference in New York, JPMorgan Chase CEO Jamie Dimon inspired his friends to “combat again” towards regulators. A number of months earlier than that, the financial institution mentioned that it might sue the CFPB over its investigation into peer-to-peer funds community Zelle.

“We’re suing our regulators time and again and over as a result of issues have gotten unfair and unjust, and they’re hurting corporations, a number of these guidelines are hurting lower-paid people,” Dimon mentioned on the conference.

Now, there’s rising consensus that an preliminary push to “delete” the CFPB is a mistake. In addition to growing the menace posed from non-banks, present guidelines from the CFPB would nonetheless be on the books, however no one can be round to replace them because the business evolves.

Small banks and credit score unions can be much more deprived than their bigger friends if the CFPB had been to go away, business advocates say, since they had been by no means regulated by the company and would face the identical regulatory scrutiny as earlier than.

“The traditional knowledge just isn’t proper that banks simply need the CFPB to go away, or that banks need regulator consolidation,” mentioned an government at a serious U.S. financial institution who declined to be recognized talking in regards to the Trump administration. “They need considerate insurance policies that may assist financial development and keep security and soundness.”

A senior CFPB lawyer who misplaced his place in latest weeks mentioned that the business’s alignment with Republicans could have backfired.

“They’re about to stay in a world during which all the non-bank monetary providers business is unregulated on daily basis, whereas they’re overseen by the Federal Reserve, FDIC and OCC,” the lawyer mentioned. “It is a world the place Apple, PayPal, Money App and X run wild for 4 years. Good luck.”