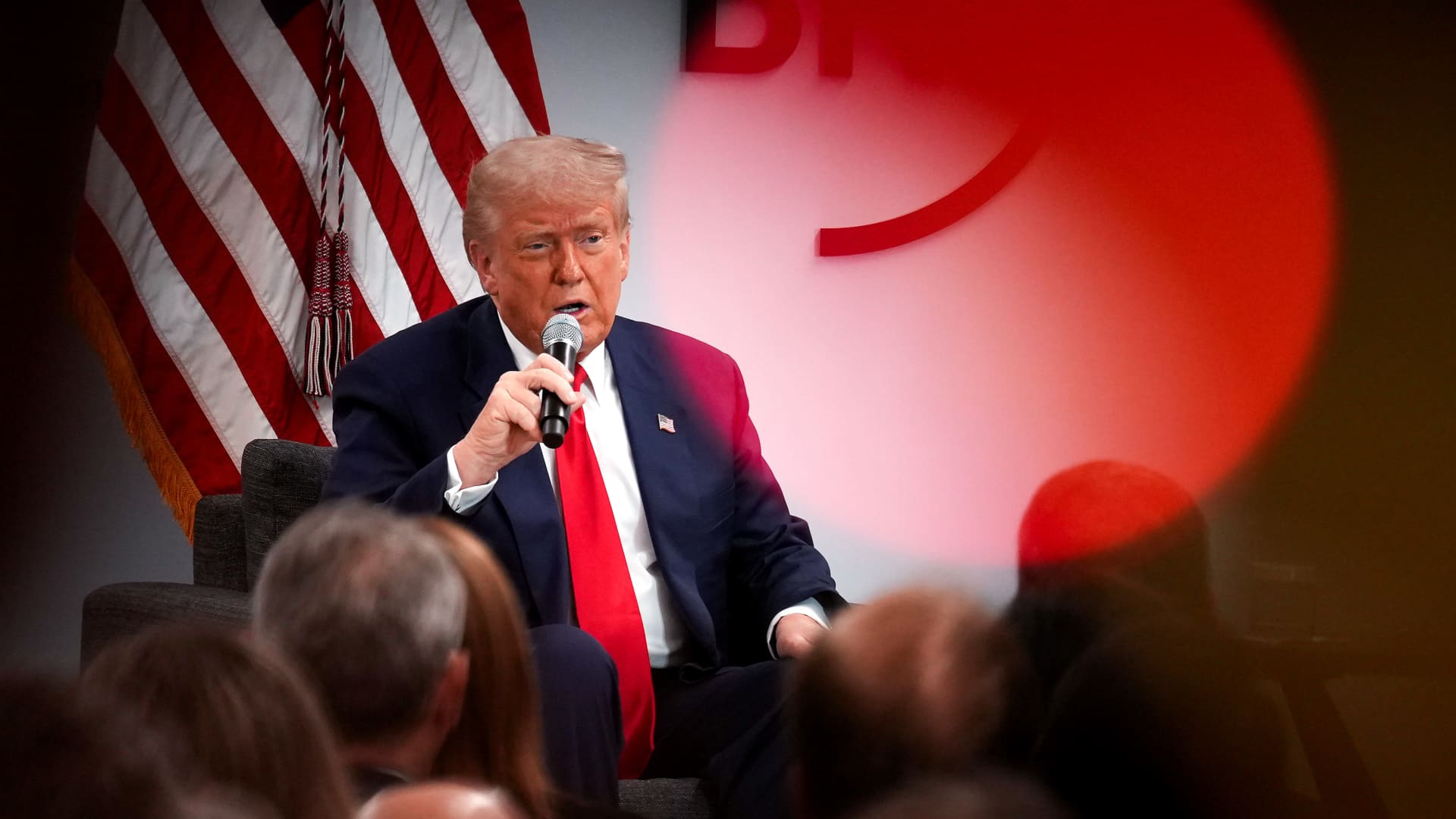

U.S. President Donald Trump delivers remarks on the Enterprise Roundtable’s quarterly assembly on the Enterprise Roundtable headquarters on March 11, 2025 in Washington, DC.

Andrew Harnik | Getty Photos

America’s richest and strongest firms shelled out tens of millions to fund President Donald Trump’s inauguration festivities.

Three months later, some could also be asking whether or not the famously transactional president has their backs. A lot of these companies have had their companies roiled by Trump’s tariff coverage and ensuing shopper warning, dampening the optimism a lot of the enterprise and finance group felt when he was reelected.

Among the nation’s largest firms, together with Basic Motors, BlackRock and Meta, donated to Trump’s inaugural committee, main it to boost a file $239 million – greater than the earlier three inaugural committees took in mixed, based on filings launched Sunday.

Presidential inaugural committees are arrange as charitable organizations, and the cash they increase has historically funded parades and galas across the president’s formal swearing in. Not like presidential election campaigns, there isn’t a set restrict on how a lot an organization or U.S. citizen can provide to an inaugural committee. (President Joe Biden didn’t have conventional inaugural occasions in 2021 as a result of Covid pandemic).

This makes inaugural donations an early alternative for firms to publicly present help for the incoming president. And in Trump’s case particularly, to make sure that the corporate has a seat on the desk as coverage choices are being made.

Inaugural committees should disclose their donors, however they aren’t required to reveal how they spend the cash. After elevating a whole lot of tens of millions of {dollars} greater than it prices to placed on three balls and an indoor parade, the Trump inaugural committee is anticipated to place the remainder towards Trump’s eventual presidential library.

A few of this 12 months’s donors, like Goal, McDonald’s and Delta Air Traces, hadn’t contributed to an inaugural committee in additional than a decade. Others together with Pfizer, Walmart and Visa have been common contributors, as they donated the identical quantities in 2025 that they did in 2021 and 2017.

What nearly each donor had in widespread was they wrote their checks at a time when the enterprise group was nonetheless using excessive on the president’s victory. Client confidence was surging, Trump had promised tax cuts have been coming and triple-digit tariffs on important buying and selling companion China weren’t a part of the dialog.

However within the weeks and months since, lots of those self same companies have seen their companies upended by Trump’s financial insurance policies, which have centered on tariffs that economists from throughout the ideological spectrum have warned may increase prices for customers and tip the financial system right into a recession.

Banks that have been anticipating a resurgence in IPOs and offers are as an alternative contending with skittish capital markets. Some airways that have been enthusiastic about deregulation and a authorities that might be friendlier to companies at the moment are slashing their steering, saying customers will not journey after they’re unsure about the way forward for their wallets.

“The expectation was as a result of the final administration was very, very tough for enterprise, very, very tough to have interaction and to speak broadly throughout all industries, the expectation was that this might be improved,” Goldman Sachs CEO David Solomon stated on CNBC’s “Squawk Field” on Tuesday. “There are specific issues which were put ahead from a coverage perspective that, you recognize, that do not really feel in keeping with the expectation individuals had.”

Whereas Trump and key administration officers have given indicators they might quickly scale back the tariffs on Chinese language imports, sending inventory markets increased, there is no assure they may strike a deal to take action.

Firms talked about on this report both didn’t reply to requests for remark, declined to remark or highlighted their previous help for inaugurations for each political events or insurance policies they contemplate good for enterprise.

Past companies, most of the people who contributed to Trump’s inauguration at the moment are working carefully with the White Home or shaping coverage.

Sam Altman, the CEO of OpenAI, donated $1 million to the inauguration. He’s now engaged on the Stargate Venture, a collaboration between OpenAI and the federal government to construct AI infrastructure within the U.S.

Jared Isaacman, Trump’s nominee for NASA administrator, donated $2 million to the inauguration. Treasury Secretary Scott Bessent gave $250,000.

This is a better have a look at the methods varied industries contributed to Trump’s inauguration and the way these companies are faring three months into his administration.

Tech

The tech business’s largest firms — and lots of of their CEOs — lined as much as donate to Trump’s inaugural fund as a part of a focused effort at making a friendlier relationship with the White Home after a tumultuous 4 years throughout Trump’s first time period.

Meta CEO Mark Zuckerberg was desirous to get into the president’s good graces after his platform kicked Trump off within the wake of the Jan. 6 Capitol riots. Trump later gave the corporate founder the nickname “Zuckerschmuck,” and he routinely known as Fb an “enemy of the individuals.”

Amazon founder and former CEO Jeff Bezos was one other frequent Trump goal, largely as a consequence of his possession of the Washington Put up, and he too has rushed to appease the president this time round.

Meta and Amazon every donated $1 million to the inaugural fund, as did Google and Apple CEO Tim Prepare dinner. Microsoft and Adobe kicked in the identical quantity. So did AI infrastructure gamers Nvidia and Broadcom. Uber did the identical.

Throughout the business, firms have been hopeful {that a} second Trump administration would loosen up on laws following a burdensome period beneath Biden, when IPOs floor to a halt and large merger efforts have been quashed.

The business is now getting hammered by Wall Road on concern {that a} mixture of upper import prices and diminished enterprise spending will dramatically shrink revenue margins. For Meta and Google, the first subject is the potential for promoting budgets to dwindle, however there are different challenges that permeate your complete business.

The tech giants have been loading up on Nvidia chips and different {hardware} to construct out their infrastructure for the AI increase. These merchandise are all topic to numerous tariffs, notably items coming from China and Taiwan. Whereas Trump stated there can be an exemption for telephones, computer systems and chips, the administration later indicated that there could be separate tariffs for these merchandise.

And in terms of laws, Google and Meta are at the moment in court docket for antitrust instances. Trump’s Federal Commerce Fee on Monday filed go well with towards Uber, accusing the ride-hailing and supply firm of misleading billing and cancellation practices tied to its subscription service.

— Ari Levy

Meals and beverage

With a $5 million donation, poultry large Pilgrim’s Satisfaction was the highest contributor to Trump’s inaugural fund. Brazilian meat large JBS, Pilgrim’s largest stakeholder, is awaiting approval to go public via a twin U.S.-Brazil itemizing because it faces opposition from environmentalists, U.S. beef producers and lawmakers from each side of the aisle.

Extra broadly, the meat business has been pushing Trump to roll again laws, which his administration did throughout his first time period.

Past huge meat, McDonald’s gave to the presidential inauguration for the primary time in additional than a decade with its $1 million donation. Whereas the fast-food chain is one in every of Trump’s favourite caterers, McDonald’s may face scrutiny from Well being and Human Companies Secretary Robert F. Kennedy Jr., who has pledged to “Make America Wholesome Once more.” Kennedy has began by taking intention at synthetic meals dyes, however quick meals might be on the record; he lately praised Steak ‘n Shake for utilizing beef tallow to cook dinner its fries.

The uncertainty of tariffs and rising recession fears may additionally weigh on McDonald’s gross sales, if customers in the reduction of on their Huge Macs and McNuggets. Over the past 12 months, the corporate has already seen U.S. gross sales wrestle as diners in the reduction of on consuming out.

Fats Manufacturers, which owns Fatburger, Johnny Rockets and greater than a dozen different restaurant chains, donated $100,000 to the inaugural fund. Final 12 months, the corporate and its chair Andy Wiederhorn have been indicted over what prosecutors known as a “sham” mortgage scheme that netted him $47 million, allegations he and the corporate deny.

Trump reportedly personally fired the assistant U.S. legal professional main the case towards Fats Manufacturers and Wiederhorn in March. Nonetheless, Justice Division officers in California informed The Oregonian that the prosecution will proceed.

On the beverage facet, spirits large Diageo chipped in $125,000 in in-kind donations of drinks. Whereas the Johnnie Walker and Don Julio proprietor is dealing with increased tariffs for a few of its manufacturers, its Mexican tequila and Canadian whisky are exempt due to the U.S.-Mexico-Canada commerce settlement.

Coca-Cola and PepsiCo, each common contributors to presidential inauguration funds, wrote checks this 12 months as nicely. Each beverage firms are beneath hearth by Kennedy’s MAHA agenda, which is pushing states to hunt bans on utilizing federal meals help to purchase soda and junk meals. The American Beverage Affiliation, a commerce group that counts Keurig Dr Pepper amongst its members, additionally chipped in $250,000.

— Amelia Lucas

Retail

The retail business was one of many solely sectors that had a dour outlook after Trump was elected due to the acute affect tariffs can haven’t simply on their provide chains, but in addition on shopper confidence and spending.

That might be why each the Nationwide Retail Federation, the business’s lobbying arm, and large field large Goal contributed to the inauguration committee for the primary time in a minimum of a decade.

The NRF gave $250,000 to the fund, whereas Goal wrote a test for $1 million.

Since Trump was elected, and even earlier than, the NRF has been sounding the alarm in regards to the affect tariffs could have on customers and its retail members, calling the duties a tax on American households.

Goal is extra uncovered to tariffs than its longtime rival, Walmart, as a result of extra of its gross sales come from discretionary items like garments and residential items that are usually manufactured abroad. The discounter’s annual gross sales have been roughly flat for 4 years in a row and final month, Goal stated it expects gross sales to develop only one% for this fiscal 12 months.

Goal has additionally felt the warmth from conservative teams lately, and from consumers and potential prospects who’ve proven help for the administration and its insurance policies. Earlier this 12 months, Goal rolled again its range, fairness and inclusion efforts quickly after Trump vowed to dismantle each DEI initiative throughout the federal authorities.

The retail business has lobbied the Trump administration to take a typical sense strategy to tariffs and pressured it will likely be tough, if not unimaginable, to maneuver some manufacturing jobs again to the U.S. But it stays unclear if that push will work — particularly when the 90-day tariff pause ends in nations outdoors of China which have grow to be key manufacturing hubs, resembling Vietnam.

The very best the business has achieved thus far was a gathering on the White Home on Monday between Trump and the chief executives of Walmart, Goal and House Depot.

After the assembly wrapped, the three firms issued almost similar statements.

“We had a productive assembly with President Trump and our retail friends to debate the trail ahead on commerce,” Goal stated. “We stay dedicated to delivering worth for American customers.”

Walmart contributed $150,000 to the inaugural committee for Trump. However the Arkansas-based retail large has donated the identical quantity for the previous three inaugurations — together with Biden’s in 2021 and Trump’s first in 2017.

— Gabrielle Fonrouge and Melissa Repko

Well being care and prescribed drugs

The pharmaceutical business and a few health-care firms shelled out huge for Trump this time round. Whereas Trump has maintained his concentrate on curbing excessive health-care prices, the pharmaceutical business was banking on a softer stance on drugmakers, or a minimum of a extra open ear to their considerations about Biden-era insurance policies that cracked down on prescription drug prices and aimed to extend business competitors.

Now, drugmakers are bracing for Trump’s proposed pharmaceutical tariffs and grappling with uncertainty across the sweeping overhaul of federal well being companies beneath Kennedy, a distinguished vaccine skeptic. However Trump provided the business some reprieve final week: He signed an govt order concentrating on a legislation that enables Medicare to barter drug costs, proposing modifications lengthy sought by pharmaceutical firms.

PhRMA, the business’s highly effective commerce affiliation, and main drugmakers together with Pfizer, Merck, Johnson & Johnson, Gilead and Bayer every gave $1 million, whereas Eli Lilly contributed $500,000.

All have been first-time donors apart from Pfizer, which contributed $1 million to each Biden’s 2021 and Trump’s 2017 inaugurations.

Vaxcyte, a small clinical-stage vaccine maker, additionally donated $1 million for the primary time. The transfer could replicate rising concern amongst vaccine makers over Kennedy’s management, which already seems to be impacting U.S. vaccine coverage.

Amgen has a observe file of bipartisan help, contributing $500,000 to this 12 months’s inauguration in addition to the earlier two. Medical system maker Abbott Laboratories additionally gave $500,000 this 12 months, a notable improve from its contributions in 2021 and 2017.

Exterior of the pharmaceutical business, telehealth firm Hims & Hers Well being contributed $1 million because it seeks help for its compounded medicines, which have confronted backlash from weight reduction drugmakers like Eli Lilly.

Well being-care firms HCA Healthcare, Molina Healthcare and Blue Cross Blue Defend contributed small quantities for the primary time. All three insurers provide Medicare Benefit plans. Insurers in that market have been lobbying Trump to pursue lighter laws for these privately run authorities applications.

Centene, which supplies government-sponsored well being plans, was an outlier, contributing simply $50,000 this 12 months. That is far lower than its earlier donations of $500,000 to Biden in 2021 and $250,000 to Trump in 2017.

— Annika Kim Constantino

Finance

The most important gamers in American finance pumped more cash into Trump’s coffers this 12 months than they did for earlier inaugurations, whereas lobbying aggressively for sweeping deregulation throughout conventional and cryptocurrency markets.

JPMorgan Chase and Goldman Sachs, the largest U.S. retail financial institution and one of the crucial highly effective Wall Road companies, respectively, every gave $1 million to the Trump inauguration, in contrast with nothing for Biden’s in 2021.

Capital One, which hadn’t donated within the two earlier election cycles, gave Trump’s inaugural committee $1 million. The financial institution on the time was looking for approval for its $35 billion acquisition of Uncover Monetary, introduced in early 2024 and at last greenlit final week.

The identical is true for BlackRock and Blackstone, the dual titans of the asset administration universe, which every gave $1 million to the inauguration fund after not donating within the two earlier election cycles.

The stakes for banks have been excessive. JPMorgan CEO Jamie Dimon has repeatedly complained in regards to the “regulatory assault” from Biden-era banking regulators that might hit income by tens of billions of {dollars} and add capital necessities for the largest U.S. banks.

Dimon and others, together with financial institution commerce teams, fought again towards efforts to extend capital necessities on the business, dubbed the Basel III Endgame. In addition they opposed a collection of Client Monetary Safety Bureau guidelines designed to restrict overdraft and bank card late charges.

Due to the takeover of the CFPB by Trump decide Russell Vought and the nomination of Michelle Bowman as Federal Reserve vice chair for supervision, it seems banks will get a lot of what they hoped for. Vought has dropped a string of excessive profile authorized instances towards banks and different monetary companies whereas making an attempt to shutter the company, whereas Bowman is taken into account to be pleasant to the business.

However monetary companies have extra urgent points lately. Considerations that Trump’s aggressive commerce insurance policies will begin a recession have hammered financials in latest weeks, pushing the KBW Financial institution Index right into a bear market decline of 20% from its post-election excessive.

Shares of Blackstone have been hit much more, down about 38% from their November 2024 excessive, on considerations that tariff uncertainty will make it arduous for the personal fairness business to promote its portfolio firms.

Crypto gamers additionally gave generously. Robinhood contributed $2 million to the inaugural committee after not donating within the two earlier elections, whereas the Coinbase founder and his firm gave a mixed $2 million.

The business has already benefited from a loosening of restrictions round cryptocurrency and banking spurred by the Trump administration, and laws is progressing that can permit extra gamers to supply stablecoins to retail prospects.

— Hugh Son

Airways and aerospace

Delta and United, which every gave $1 million to the Trump inauguration, are reducing their home capability plans this 12 months as a consequence of weaker demand, notably from the financial system cabin. (About $250,000 of United’s contribution was an in-kind donation of flights).

Months earlier, in November, Delta CEO Ed Bastian stated that the incoming Trump administration would doubtless be a “breath of contemporary air” when it comes to regulation after Biden’s Transportation Division. Throughout Biden’s administration, the DOT issued a bunch of latest guidelines geared toward defending customers from airline charges and guaranteeing they get refunds if flights are delayed or canceled.

Earlier this month, Bastian took a special tone on the administration when the provider reported quarterly earnings. In an interview, Bastian known as Trump’s tariff coverage “the unsuitable strategy” and stated it harm bookings, main Delta to tug its 2025 earnings forecast.

Boeing, which additionally gave $1 million to the Trump inauguration, is the nation’s prime exporter and is as soon as once more caught in commerce conflicts, none extra pronounced than the tit-for-tat tariffs with China.

Boeing’s CEO Kelly Ortberg stated Wednesday that China has stopped taking deliveries of its plane amid the commerce conflict. He stated the corporate may hand over a few of the airplanes that have been destined for Chinese language airways to different prospects this 12 months.

Whereas Boeing makes its plane in the USA, the corporate and the producers of enormous plane elements like engines and wings depend on a worldwide provide chain that might be impacted by a broad-based 10% tariffs on a lot of the world that Trump imposed earlier this month, in addition to duties on imported aluminum and metal.

Main aerospace suppliers are additionally within the crosshairs of the commerce conflict. Even in the event that they produce their exported merchandise within the U.S., firms are reliant on a worldwide provide chain that is nonetheless fragile from the Covid-19 pandemic and might be impacted by tariffs. Overseas firms producing items within the U.S. are additionally affected, like Airbus, which assembles a few of its narrow-body planes in Alabama, however depends on imports.

GE Aerospace CEO Larry Culp met with Trump and different White Home officers this month and stated he recommended that the business be capable to return to the largely duty-free commerce it is loved beneath a 45-year-old settlement.

“We’ve recommended, because the administration works via a myriad of points, is that they will contemplate the place of energy that the nation enjoys on account of this tariff-free regime and to think about reestablishing the identical,” stated Culp.

RTX and GE Aerospace, a protection contractor and industrial aerospace provider, respectively, estimated Tuesday that increased bills from tariffs will price their companies greater than $1 billion mixed. GE stated it can offset $500 million with company price cuts and value will increase.

— Leslie Josephs

Autos

American-based automakers resembling Ford Motor and Basic Motors have contributed to inaugurations previously, however they elevated their donations from a whole lot of hundreds of {dollars} to $1 million or extra, together with autos, for Trump’s inauguration this 12 months.

GM, Ford and the North American operations for Chrysler guardian Stellantis every donated a minimum of $1 million to this 12 months’s inauguration. Ford, as disclosed in Sunday’s submitting, additionally supplied roughly $200,000 in car providers as in-kind donations. GM supplied autos as nicely, however the financial worth was not instantly out there.

Along with the normal “Detroit automakers,” foreign-based firms Hyundai Motor and Toyota Motor additionally donated $1 million to the fund via their American operations, after not contributing to the previous two inaugurations.

In whole, the automotive sector donated roughly $5.3 million to Trump’s inauguration, together with $100,000 from Schumacher Automotive, a vendor group based mostly close to Mar-a-Lago in West Palm Seaside, Florida.

For the reason that inauguration, Trump has brought about what some, resembling Ford CEO Jim Farley, have described as “chaos” round automotive tariffs and inconsistent messaging across the levies. The business is at the moment coping with 25% tariffs on supplies resembling metal and aluminum, in addition to 25% levies on imported autos from outdoors of the U.S. Tariffs on automotive elements imported into the U.S. are additionally set to take impact by Might 3.

The brand new levies have been launched and carried out swiftly, making it tough for the automotive business to plan, particularly for anticipated will increase in the price of auto elements.

Many smaller suppliers should not outfitted to alter or transfer manufacturing operations rapidly and will not have the capital to pay for tariffs, doubtlessly inflicting stoppages in manufacturing.

“Most auto suppliers should not capitalized for an abrupt tariff induced disruption. Many are already in misery and can face manufacturing stoppages, layoffs and chapter,” six of the highest coverage teams representing the U.S. automotive business wrote in a letter to Trump administration officers. “It solely takes the failure of 1 provider to result in a shutdown of an automaker’s manufacturing line. When this occurs, because it did through the pandemic, all suppliers are impacted, and staff will lose their jobs.”

The assertion adopted Trump saying he could “assist” some auto firms who want extra time to maneuver manufacturing or discover new suppliers, however he has not introduced any precise plans since then.

— Mike Wayland