Customers solid shadows as they carry their baggage alongside the waterfront in Portland, Maine, U.S, December 26, 2024.

Kevin Lamarque | Reuters

It isn’t simply Walmart.

The leaders of corporations that serve everybody from penny-pinching grocery buyers to first-class vacationers are seeing cracks in demand, a shift after resilient customers propped up the U.S. financial system for years regardless of extended inflation. On prime of excessive rates of interest and protracted inflation, CEOs are actually grappling with tips on how to deal with new hurdles like on-again, off-again tariffs, mass authorities layoffs and worsening shopper sentiment.

Throughout earnings calls and investor displays in latest weeks, retailers and different consumer-facing companies warned that first-quarter gross sales had been coming in softer than anticipated and the remainder of the 12 months may be more durable than Wall Road thought. Most of the executives blamed unseasonably cool climate and a “dynamic” macroeconomic surroundings, however the early days of President Donald Trump’s second time period have introduced new challenges — maybe none larger than making an attempt to plan a worldwide enterprise at a time when his administration shifts its commerce insurance policies by the hour.

Economists largely count on Trump’s new tariffs on items from China, Canada and Mexico will increase costs for customers and dampen spending at a time when inflation stays larger than the Federal Reserve’s goal. In February, shopper confidence — which might help to sign how a lot buyers are keen to shell out — noticed the largest drop since 2021. A separate shopper sentiment measure for March additionally got here in worse than anticipated.

NYSE Arca Airline Index versus the S&P 500.

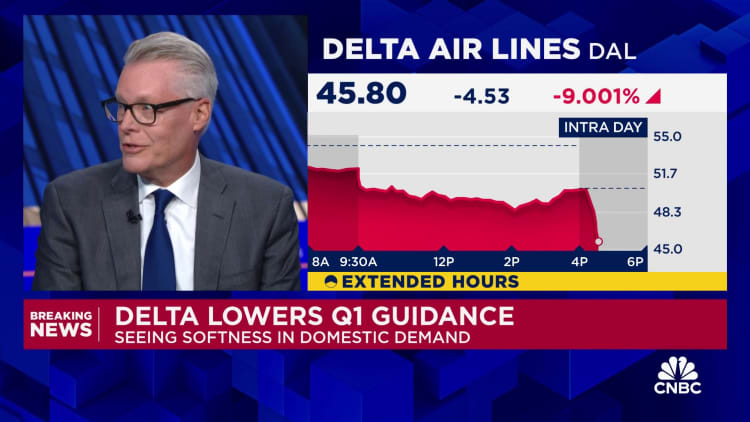

One other signal of weak point has been in air journey. The sector, particularly giant worldwide airways, had been a vivid spot following the pandemic, with customers proving many times that they would not hand over journeys even within the face of the largest soar inflation in additional than 4 many years. This week, nevertheless, the CEOs of the 4 largest U.S. airways — United, American, Delta and Southwest — mentioned they’re seeing a slowdown in demand this quarter. American, Delta and Southwest minimize their first-quarter forecasts.

Plus, the job market, whose energy lately has been the nation’s financial glue, is exhibiting early indicators of stress as job development slows and unemployment ticks up.

These tendencies have thrown chilly water on what was a red-hot inventory market and sparked new fears a couple of potential recession, sending the S&P 500 tumbling 10% from its file highs in February, although it had recovered some floor as of Friday morning buying and selling.

Now, as buyers and executives develop extra frightened in regards to the affect tariffs could have on shopper spending and fret about an administration that they had excessive hopes for just some months in the past, even the strongest corporations are hanging cautious tones because the weaker ones get even louder.

Take Walmart, the retail business’s de facto chief, which has spent the final 12 months turning an unsure financial system into gas for development because it courted higher-income customers. When Walmart introduced fiscal fourth-quarter earnings final month, its inventory fell after it warned that revenue development could be slower than anticipated within the 12 months forward. It was a uncommon warning signal from an organization that tends to thrive in a weaker financial system, and a sign that it is anticipating customers to drag again from higher-margin discretionary items in favor of necessities like milk and paper towels within the 12 months forward.

“We do not need to get out over our skis right here. There’s a number of the 12 months to play out,” Walmart’s finance chief, John David Rainey, informed analysts when discussing the corporate’s outlook. “It is prudent to have an outlook that’s considerably measured.”

Charly Triballeau | Afp | Getty Photographs

Ed Bastian, chief govt of Delta Air Strains – probably the most worthwhile U.S. service that has reaped the rewards of massive spenders lately – struck an analogous tone after it slashed its earnings and income forecast for the primary quarter. In an interview Monday on CNBC’s “Closing Bell,” Bastian mentioned that shopper confidence has weakened and that each leisure and enterprise clients have pulled again on bookings, which led it to chop its steering.

“Shoppers in a discretionary enterprise don’t like uncertainty,” mentioned Bastian. “And whereas we do imagine this might be a time period that we cross via, additionally it is one thing that we have to perceive and get to calmer waters.”

To make sure, it wasn’t simply fewer folks reserving journeys that led the airline to chop its first-quarter forecast. Questions on air security compounded the issue after two main airline accidents, together with Delta’s personal crash touchdown in Toronto, wherein nobody died.

Past Delta, rival United mentioned it is going to retire 21 plane early, a transfer that goals to chop prices.

“We have now additionally seen weak point within the demand market,” Kirby mentioned at Tuesday’s JPMorgan airline business convention. “It began with authorities. Authorities is 2% of our enterprise. Authorities adjoining, all the opposite consultants and contracts that go together with which can be in all probability one other 2% to three%. That is working down about 50% proper now. So a fairly materials affect within the quick time period.”

The airline has seen a few of that dynamic “bleed over” into the home leisure market, as effectively, Kirby added. He mentioned the corporate is already the place it is going to minimize flights, eyeing an enormous drop in site visitors from Canada into the U.S. and in markets that had been fashionable with authorities employees.

American Airways minimize its first-quarter earnings forecast and mentioned along with demand pressures, bookings had been harm after a lethal midair collision of an Military helicopter with one among its regional jets in Washington D.C. in January.

The corporate additionally felt the pullback in authorities journey and related journeys like these for contractors.

“We all know that there is some follow-on impact by way of leisure journey related to that as effectively,” mentioned CEO Robert Isom.

Airline executives had been upbeat about longer-term demand in 2025, nevertheless.

Different sturdy corporations, equivalent to Dick’s Sporting Items, E.l.f. Magnificence and Abercrombie & Fitch, additionally issued weak forecasts in latest weeks, although they indicated they had been feeling constructive in regards to the second half of the 12 months.

“I do suppose it is only a little bit of an unsure world on the market proper now,” Ed Stack, the chairman of Dick’s Sporting Items, informed CNBC when requested in regards to the firm’s steering. “What is going on to occur from a tariff standpoint? You already know, if tariffs are put in place and costs rise the way in which that they could, what is going on to occur with the patron?”

During the last 12 months, corporations like United, Walmart and Abercrombie have managed to outperform the S&P 500, at the same time as buyers decreased discretionary spending, so this variation in commentary marks a significant shift. It is a warning signal that buyers may very well be beginning to crack, and that even glorious execution isn’t any match for tariff-induced value will increase after 4 years of historic inflation.

In the meantime, the businesses which have already spent the final 12 months calling out unsure shopper dynamics are sounding much more frightened.

“Our clients proceed to report that their monetary scenario has worsened during the last 12 months, as they’ve been negatively impacted by ongoing inflation. A lot of our clients report they solely come up with the money for for fundamental necessities, with some noting that they’ve needed to sacrifice even on the requirements,” the CEO of Greenback Basic, Todd Vasos, mentioned on the corporate’s fourth-quarter earnings name Thursday, including clients predict worth and comfort “greater than ever.” The worsening shopper outlook has compounded the corporate’s personal inner challenges.

“As we enter 2025,” Vasos continued. “We’re not anticipating enchancment within the macro surroundings, notably for our core buyer.”

Elsewhere within the retail business, American Eagle on Tuesday warned that chilly climate led to a slower than anticipated begin to the primary quarter, however mentioned it wasn’t simply temperatures. The attire retailer particularly known as out “much less strong demand” and mentioned it is taking steps to scale back bills and handle stock because it braces for what’s nonetheless to come back.

“[Consumers] have the worry of the unknown. Not simply tariffs, not simply inflation, we see the federal government chopping folks off. They do not know how that is going to have an effect on them. They see applications being minimize, they do not know how that is going to have an effect on them,” mentioned CEO Jay Schottenstein. “And when folks do not know what they do not know – they get very conservative… it makes everybody a bit of nervous.”