For years, airways and resort chains have leaned on loyalty applications to retain frequent vacationers, particularly in premium markets. However in Europe, loyalty has all the time been extra fluid — and that pattern is accelerating. At the same time as journey demand rebounds post-pandemic, European shoppers are signaling a transparent shift in mindset: loyalty is not earned by factors alone.

Our newest analysis reveals a rising pattern of loyalty leakage throughout the area. Frequent flyer applications and resort memberships are more and more being bypassed in favor of flexibility, worth transparency, and comfort — with on-line journey companies capitalizing on the shift.

A Delicate Loyalty Base in Europe

The U.S. has round 55% of vacationers enrolled in loyalty applications, and lots of European markets aren’t far behind on the floor — France and Spain, as an example, hover close to 50%. However the story isn’t nearly enrollment charges. It’s about who’s collaborating and the way engaged they’re.

Within the UK, solely 35% of vacationers report being members of any airline or resort program. Throughout Europe, engagement is decrease amongst youthful vacationers (18–24) and older ones (65+), with the 35–44 age group almost certainly to be enrolled. Curiously, mid-income vacationers (€25,000–49,999) present larger membership charges than each lower- and higher-income teams — a reversal of the U.S. sample, the place loyalty participation sometimes will increase with revenue.

These patterns spotlight a key perception: the very segments loyalty applications have historically focused — youthful and prosperous vacationers — aren’t constantly participating in Europe. That’s a critical problem for journey manufacturers seeking to construct long-term relationships in a fragmented and price-sensitive market.

From Standing to Financial savings

What’s driving the shift?

For European vacationers, worth has overtaken perks as the first loyalty driver. Amongst current program joiners, practically half (45%) say they signed up purely to economize. The enchantment of upgrades, lounge entry, or elite standing has diminished — simply 7% say they be part of for premium experiences.

This marks a basic departure from the normal loyalty mannequin, which has lengthy been centered on exclusivity and long-term reward accumulation. Right this moment’s vacationers — notably youthful ones — need fast worth, not aspirational perks.

Inns Are Struggling Extra Than Airways

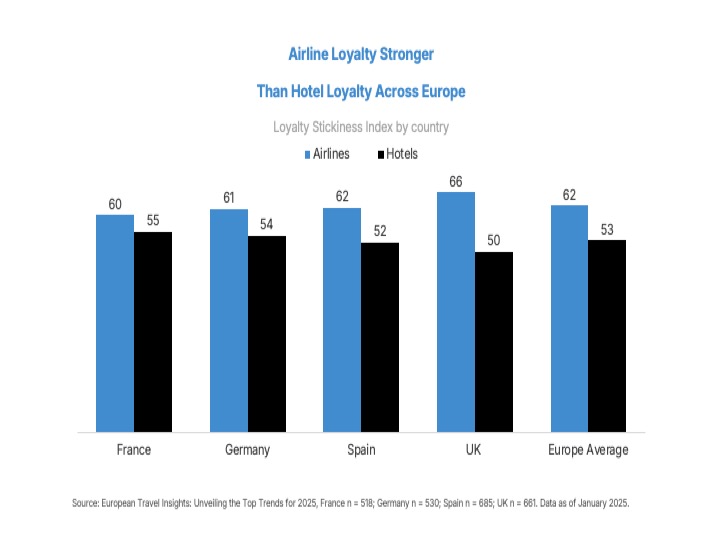

Whereas airline loyalty is eroding, resort chains are below even better strain. Based on Skift Analysis’s proprietary Loyalty Stickiness Index, European vacationers give resort loyalty applications a weaker rating (53 out of 100) in comparison with airline applications (62) — and the hole is widening.

The Index tracks traveler conduct by analyzing two issues: how typically they ebook inside their most well-liked program, and the way often they ebook outdoors it. A decrease rating indicators a better tendency to buy round — and fewer model dedication.

Inns are notably susceptible. The rise of trip leases, metasearch instruments, and bundled choices by on-line reserving platforms has made comparability purchasing easy. As worth competitors turns into frictionless, the worth of staying loyal to a single resort model diminishes — and loyalty turns into one of many first casualties.

Latest improvements additionally present how some manufacturers are attempting to fight this pattern. For example, Mandarin Oriental’s revamped app and loyalty program is designed to enhance digital engagement and seize extra direct bookings. Most of these digital investments point out a broader shift towards creating extra personalised and frictionless loyalty experiences.

Why Loyalty Doesn’t Stick

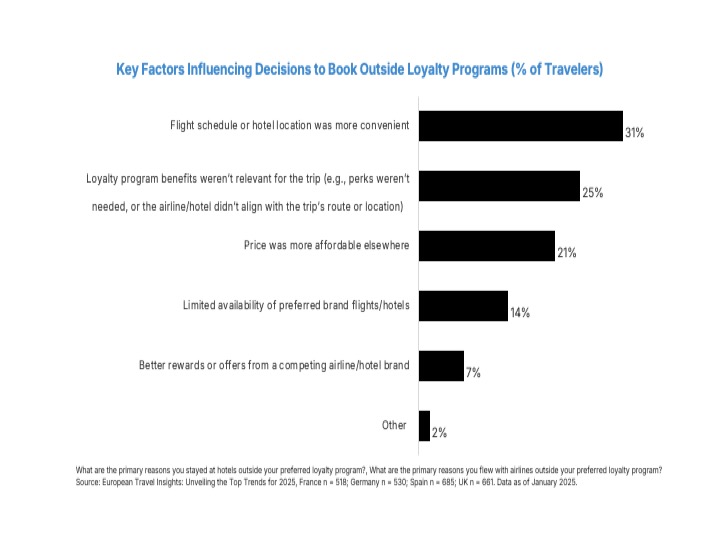

Even amongst enrolled members, many applications battle to transform sign-ups into repeat bookings. Comfort routinely outweighs model allegiance — vacationers prioritize higher schedules, prime places, and seamless reserving experiences over staying inside a loyalty ecosystem.

Many additionally discover program advantages misaligned with their journey model. For price-sensitive vacationers, decrease fares or room charges elsewhere typically trump future rewards. Redemption hurdles, restricted stock, and the rise of engaging competitor incentives — akin to cashback and standing matches — additional erode stickiness.

Loyalty, briefly, has turn into transactional, not emotional.

British Airways, for instance, has not too long ago ramped up its loyalty messaging to reassure frequent flyers amid elevated competitors and client uncertainty. This implies that whereas engagement could also be waning, manufacturers nonetheless acknowledge the worth of emotional reassurance and direct communication in retaining loyalty.

The Highway Forward: Reinvent or Be Changed

Is that this the top of loyalty as we all know it? Not essentially. Nevertheless it’s clear that the outdated mannequin is not working — particularly in Europe.

Journey manufacturers should redefine loyalty round what right now’s vacationers worth most: flexibility, simplicity, and fast advantages. Applications with no-barrier rewards, clear pricing, and seamless integration with on-line journey companies or co-branded fintech choices are more likely to see stronger engagement.

Whereas the U.S. mannequin of status-driven loyalty would possibly nonetheless maintain sway domestically, European vacationers are voting with their wallets. On this setting, loyalty is not a behavior — it’s a deliberate, value-based selection.

The European loyalty panorama is present process a quiet however seismic shift. Conventional applications should evolve from being standing golf equipment to worth engines. In the event that they don’t, vacationers received’t suppose twice earlier than strolling away — no matter what number of factors they’ve earned.