The European journey panorama is present process a change, with shifting budgets, evolving loyalty developments, and new reserving behaviors shaping the trade. Skift Analysis’s newest report, European Journey Insights: Unveiling the High Tendencies for 2025, breaks down the largest shifts in traveler habits.

The Crossroads of Journey Budgets

Europe’s journey financial system is at a crossroads. Whereas some vacationers are desirous to spend, others are feeling the strain of financial uncertainty.

The most recent knowledge reveals that 39% to 48% of vacationers report no adjustments to their journey budgets, but considerations about affordability are nonetheless shaping spending selections.

Many vacationers are prioritizing flexibility, with 24% rising their spending on refundable bookings and 33% putting a better emphasis on journey safety. In the meantime, finances pressures persist, with 28% elevating their journey finances whereas 20% are chopping again.

These changes are resulting in a brand new sample in spending — some vacationers are splurging on experiences and lodging, whereas others are cutting down, with 25% lowering their journey frequency and 22% choosing shorter stays slightly than eliminating journey altogether.

Worth-Pushed Pricing: The New Regular?

Because of this, companies should give attention to providing value-driven pricing. Refundable bookings, journey insurance coverage, and strategic reductions will play a key function in capturing the eye of cautious vacationers.

The query now’s whether or not these finances shifts translate to a long-term change in journey habits.

Rising Journey Budgets: Delusion or Actuality?

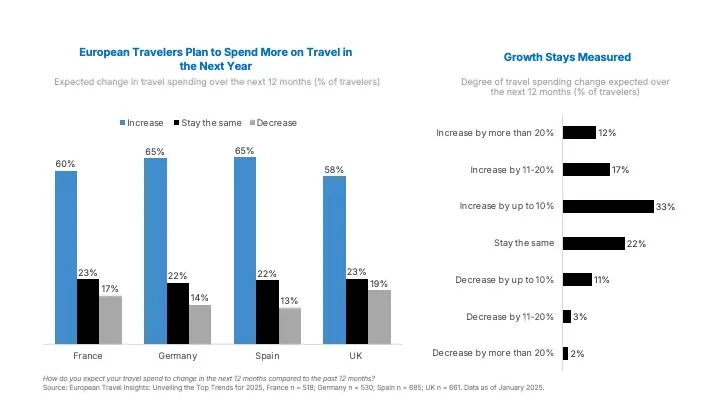

Whereas spending stays steady for a lot of, development in journey budgets is modest. Throughout Europe, Spain and Germany lead the pattern, with 65% of vacationers anticipating to spend extra on journey within the subsequent yr, whereas the UK trails at 58%.

The vast majority of vacationers expect an increase of as much as 10%, with simply 12% predicting their spending will improve by greater than 20%. This implies that rising prices — not a surge in discretionary spending — are driving increased budgets.

Value sensitivity stays excessive, that means manufacturers that may ship a stability between affordability and premium experiences may have a aggressive edge.

Loyalty is Altering: Who Holds the Edge?

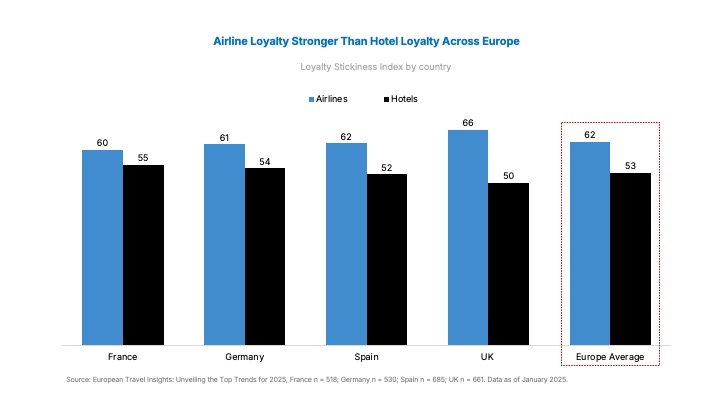

Loyalty developments are shifting, with airways sustaining stronger buyer retention than accommodations. UK vacationers report the very best airline loyalty scores at 66, with the European common at 62. In distinction, resort loyalty stays weaker, with a median rating of 53 throughout Europe.

Our Loyalty Stickiness Index measures how persistently vacationers interact with manufacturers regardless of value fluctuations. The information reveals that whereas frequent vacationers take part in loyalty applications, many stay versatile and prepared to modify manufacturers for higher pricing or comfort.

To strengthen retention, manufacturers should evolve past conventional loyalty applications, providing personalised, experience-driven rewards that create stronger emotional connections with vacationers.

What’s Subsequent for European Journey?

From reserving developments to shifting model preferences, the European journey market is evolving quickly. Understanding who’s spending, how they’re spending, and why they’re switching manufacturers is the important thing to success in 2025.

As vacationers navigate financial pressures, manufacturers that supply adaptable, consumer-focused options will emerge as winners. For airways, accommodations, OTAs, and tourism boards, this report is your roadmap to navigating these adjustments.