Asia’s outbound journey is again, nevertheless it seems to be very completely different throughout the area’s three most essential markets: India, China, and Japan.

Skift Analysis’s newest report, Asia Rising: Contained in the Minds of 2025’s Most Helpful Vacationers, unpacks what’s driving these markets, the place they’re headed, and the way journey manufacturers should adapt.

Home and regional journey are the clear winners in Asia’s restoration story. India and China have bounced again with drive, exhibiting a surge in home motion and short-haul worldwide journeys. Japan, against this, stays extra hesitant — a market nonetheless cautious, nonetheless restrained.

After we examine present journey exercise to 2019, the image is unmistakable: Lengthy-haul isn’t main Asia’s return. As an alternative, the area is rewriting its journey script with a stronger give attention to proximity, frequency, and familiarity.

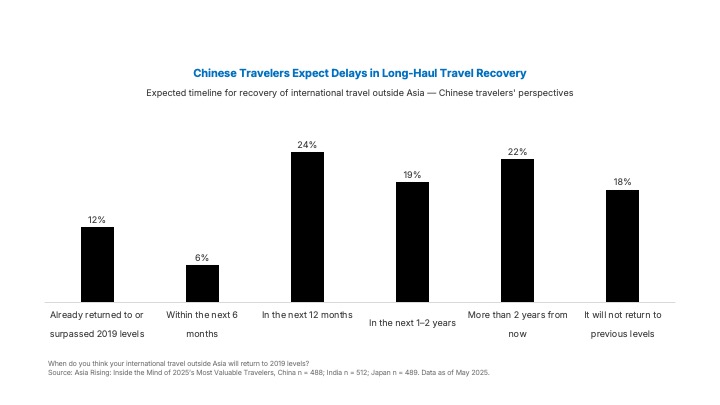

China’s Lengthy-Haul Journey Hesitation

Regardless of outbound journey spending climbing again to $250.6 billion in 2024, China hasn’t regained its pre-pandemic long-haul momentum. There’s a deeper shift underway. As we speak’s Chinese language traveler is more and more inclined to remain nearer to house, pushed by a mixture of geopolitical warning, rising security consciousness, and a reevaluation of journey’s objective.

The urge for food for exploring distant markets has dimmed — not disappeared, however now not computerized. That is no short-term pause; it’s a structural recalibration.

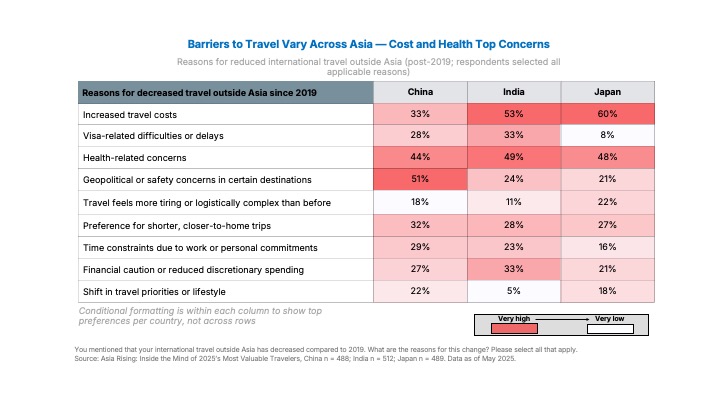

What’s Holding Vacationers Again

Limitations to outbound journey stay, however they’re evolving.

In China, the shadow of geopolitics looms massive, coupled with lingering security anxieties and the psychological weight of the pandemic. India and Japan are confronting a unique set of obstacles: surging journey prices which can be reshaping decision-making throughout revenue segments.

Visa points, restricted air connectivity, and well being considerations lower throughout all three markets, creating friction at each stage of the traveler journey. These hurdles don’t simply delay journeys — they reshape vacation spot decisions and dampen long-haul demand.

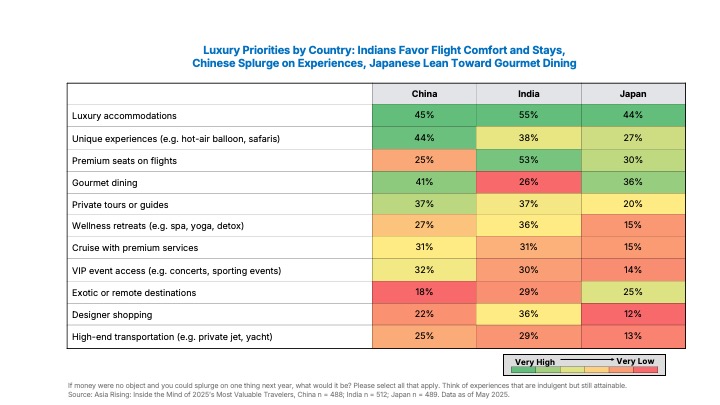

Splurges Present Regional Persona

When Asian vacationers do select to spend, their preferences reveal hanging cultural nuance. Everybody desires luxurious lodging, however past that, every market indulges in a different way.

- India gravitates towards premium flights, designer purchasing, and wellness-focused escapes.

- Chinese language vacationers are drawn to wealthy, immersive experiences — safaris, non-public excursions, and refined eating that sign depth and personalization.

- Japanese vacationers, in the meantime, embrace connoisseur delicacies and upgraded flights however stay reserved relating to high-touch, over-the-top extras.

Beneath the shared need for consolation lies a layered, regional story of what luxurious actually means.

Asia isn’t returning to previous habits. It’s shifting ahead with a brand new set of expectations, values, and priorities. For journey manufacturers hoping to have interaction with the area’s most useful vacationers in 2025, understanding these shifts is non-negotiable.

Learn the total report → Asia Rising: Contained in the Minds of 2025’s Most Helpful Vacationers