Saudi Arabia has opened up overseas funding into actual property corporations in its holy cities this week, a transfer that may assist growth within the kingdom’s most profitable tourism locations. Listed firms that personal actual property in Makkah and Madinah can now obtain funding from non-Saudis.

The Saudi market regulator Capital Market Authority mentioned in a press release: “By way of this announcement, the Capital Market Authority (CMA) goals to stimulate funding, improve the attractiveness and effectivity of the capital market, and strengthen its regional and worldwide competitiveness whereas supporting the native financial system.”

“This contains attracting overseas capital and offering the mandatory liquidity for present and future initiatives in Makkah and Madinah by the funding merchandise accessible within the Saudi market, positioning it as a key funding supply for these distinctive developmental initiatives.”

The Ministry of Hajj and Umrah didn’t instantly reply to requests for touch upon how the change might impression tourism.

The CMA mentioned that the overseas funding could be restricted to shares, convertible debt devices, or each, and would exclude “strategic overseas traders.” It added that individuals with out Saudi nationality wouldn’t be allowed to personal greater than 49% of shares of the corporations concerned.

Spiritual Tourism

FDI, or overseas direct funding, is a sizzling subject in Saudi Arabia, particularly concerning tourism initiatives. Multi-billion-dollar initiatives like Neom, Diriyah and Crimson Sea draw consideration for the immense quantity of public spending they’ve required. Nevertheless, these initiatives are largely targeted on the leisure market – non secular tourism is the biggest journey phase in Saudi by a large margin.

In 2023, non secular tourism generated $28.3 billion in spending in Saudi and accounted for 11 of the 27 million worldwide vacationers that yr, in accordance with the Ministry of Tourism. Nearly twice as many worldwide vacationers visited Saudi for non secular functions in comparison with leisure functions in 2023.

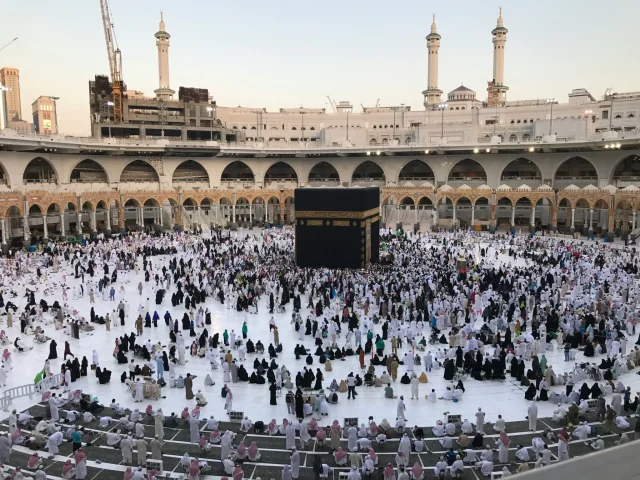

Tourism minister Ahmed Al-Khateeb affirmed at Davos this month that non secular tourism remains to be the nation’s greatest driver. “Makkah and Madinah nonetheless high the listing of probably the most visited locations in Saudi Arabia, and entice tens of millions of pilgrims yearly, attributable to their non secular significance.”

The annual pilgrimage performs an important function within the nation’s financial system and upping the variety of pilgrims is an integral a part of its Imaginative and prescient 2030 financial reform agenda that goals to wean the financial system off oil revenues.

The 2 holy cities have their very own set of initiatives, which might now be accelerated with overseas funding. Furthermore, non secular tourism is already a confirmed idea in Saudi, whereas leisure journey remains to be in its infancy, permitted solely since 2019.

Makkah:

- Masar Vacation spot: This growth venture will cowl 1.2 sq. kilometers and goals to remodel Mecca’s city panorama. Centered across the King Abdulaziz Street, it is going to function residential and industrial areas, cultural facilities, and leisure amenities. The venture is predicted to be accomplished by 2030 with an estimated price of $26.66 billion.

Madinah:

- Rua Al Madinah: In Madinah, a deliberate city growth venture will span 1.5 sq. kilometers close to the Prophet’s Mosque. Upon completion, it goals to accommodate as much as 30 million Umrah pilgrims by 2030. The primary section is scheduled for completion in 2026, with the ultimate section by 2030, at an estimated price of $37 billion.

Overseas Funding in Different Tasks

Final April, BlackRock mentioned it might be getting as a lot as $5 billion from Saudi’s Public Funding Fund to spend money on the area and construct a Riyadh-based funding crew.

That very same month, Saudi flew dozens of bankers to Neom – Saudi’s greatest venture – to discover “collaborative avenues,” in accordance with Neom’s then-CEO Nadhmi Al-Nasr in a press release. The occasion drew representatives from 24 worldwide banks and monetary establishments, together with these from Europe and the U.S. and within the area.

Media experiences have mentioned components of Neom, together with The Line, has been scaling again. However in accordance with Diriyah group CEO Jerry Inzerillo in a earlier interview with Skift, that might merely replicate shifting priorities to different Saudi initiatives.

“See, everyone is concentrated on what they suppose Neom is combating. Right here’s how to take a look at it: There was some huge cash initially dedicated to Neom, however that cash didn’t consider the Kingdom would win the bid for the 2029 Winter Video games in Trojena. So now, with the entire world going there to see the Winter Video games, it is advisable to put some huge cash into constructing Trojena.”

“Trojena might’ve been constructed after The Line, however now it’s earlier than The Line. You want Trojena for 2029. Quite a lot of it isn’t austerity, fairly the alternative. It’s redirecting the place the cash goes.”