A central premise of robotaxis is that top utilization and decrease labor prices will in the end make it an inexpensive transportation possibility. That’s nonetheless removed from true, however now there’s some knowledge that offers us an concept of by how a lot.

Obi, an app that aggregates real-time pricing and pick-up occasions throughout a number of ride-hailing providers, has simply revealed what it’s calling the “first in-depth examination of Waymo’s pricing technique.” The corporate discovered Waymo’s self-driving automobile rides to be constantly costlier than comparative choices from Uber and Lyft – and it doesn’t appear to matter.

The report, shared completely with TechCrunch, relies on a month’s value of information collected between March 25 and April 25 in San Francisco, California. Obi pulled almost 90,000 “provide data” from Waymo, Lyft’s “customary” providing, and UberX to be able to evaluate value and ETA. It then in contrast trip requests from the identical occasions and routes. Obi discovered Lyft supplied the bottom common value at $14.44. Uber was subsequent at $15.58. Waymo’s common value throughout the month’s value of information was $20.43.

Ashwini Anburajan, Obi’s chief income officer, informed TechCrunch this was considerably shocking given the early recognition of Waymo’s service. Waymo mentioned in Might it’s offering 250,000 paid journeys per week throughout its first 4 cities. Increased pricing has apparently not dimmed that pleasure.

“Colloquially, there may be an concept that autonomous automobiles are one thing that can erode driver jobs and put drivers in danger. And I believe the irony of what we’ve seen is that it’s really fairly costly to run an AV, and that that’s not going to be occurring, no less than within the close to time period,” she mentioned.

At peak hours, Obi discovered Waymo’s common value to be about $11 costlier than a Lyft and almost $9.50 pricier than an Uber.

“I didn’t anticipate customers being prepared to pay as much as $10 extra,” Anburajan mentioned. “I believe [that] speaks to an actual sense of pleasure for know-how, novelty, and an actual choice to typically be within the automobile with no driver.”

Obi discovered that not solely was Waymo costlier, however there was better variability in its pricing than with Uber or Lyft.

Anburajan mentioned one rationalization is that Waymo’s pricing mannequin will not be as refined. Uber and Lyft, she mentioned, have had greater than a decade to refine how they value rides. These platforms are additionally a bit extra dynamic, with drivers clocking out and in on their very own time, or becoming a member of or abandoning the gig work altogether.

Waymo, in the meantime, has a largely fastened however slowly rising provide of automobiles (although the tempo of that development could quickly speed up). This has led to what Anburajan mentioned is extra of a “pure provide and demand” pricing scheme.

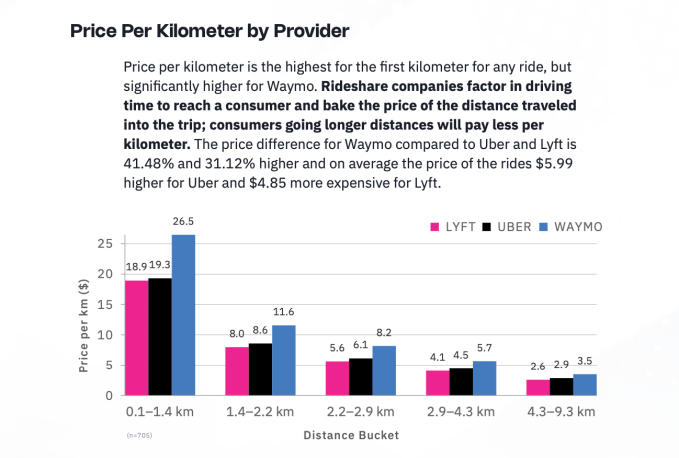

That has two large impacts on clients. One is that brief journeys are likely to price greater than longer ones. Obi discovered that Waymo rides price roughly $26 per kilometer if the trip stays beneath 1.4 km.

This was true of the Uber and Lyft rides, too. However Obi discovered the shortest Waymo rides had been priced 41.48% and 31.12% increased than Uber and Lyft, respectively. That hole shrunk because the rides acquired longer. In rides lasting between 4.3 km and 9.3 km, a Lyft price $2.60 per km, an Uber price $2.90 per km, and a Waymo price $3.50 per km.

The opposite impression is that longer wait occasions equals costlier journeys. In spite of everything, sending a automobile a protracted technique to decide up a buyer means it should carry out fewer high-margin, short-distance rides.

That also isn’t discouraging Waymo clients, Anburajan mentioned, though Obi discovered Waymo to have the next variability in wait occasions.

Along with the data-based deep dive, Obi additionally surveyed riders in Los Angeles, San Francisco, and Phoenix, Arizona to get a greater understanding of what is perhaps driving these tendencies.

The corporate discovered that 70% of customers who had taken a Waymo trip mentioned they most well-liked a driverless automobile to a conventional rideshare or taxi.

Regardless of that enthusiasm, Obi discovered that security remains to be a giant concern for riders. Of these surveyed, 74% mentioned security is their greatest concern about robotaxis. Almost 70% of respondents mentioned they suppose there must be some type of distant human monitoring of the rides (one thing that’s already a typical observe).

Maybe much more hanging is how individuals answered a query about whether or not they can be prepared to pay extra for a Waymo. Almost 40% mentioned they’d pay “the identical or much less.” However 16.3% mentioned they’d pay lower than $5 extra per trip. One other 10.1% mentioned they’d pay as much as $5 extra per trip. And 16.3% mentioned they’d pay as much as $10 extra per trip.

Anburajan mentioned responses like these assist additional clarify Waymo’s pricier rides.

“There’s one thing about being within the automobile alone” that’s profitable clients over, she mentioned. “It’s there so that you can, like, form of reside in a bit of bubble and get from level A to level B, and be very comfy doing so.”