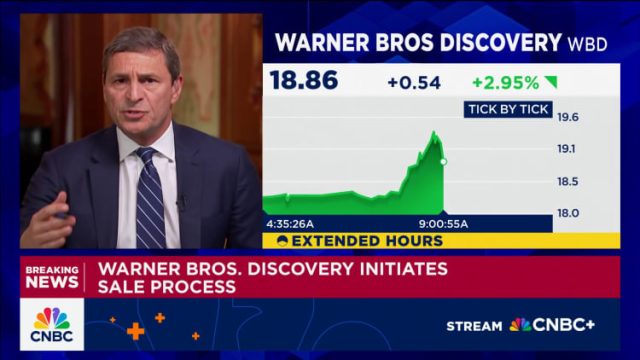

Warner Bros. Discovery mentioned Tuesday it is increasing its strategic evaluation of the enterprise and is open to a sale, sending shares of the corporate 9% increased in premarket buying and selling.

Earlier this 12 months, WBD introduced plans to separate into two separate entities, a streaming and studios enterprise and a worldwide networks enterprise. It is also been fielding takeout curiosity from the newly merged Paramount Skydance.

However on Tuesday, WBD mentioned it is obtained “unsolicited curiosity” from a number of events and can now evaluation all choices. The corporate mentioned it is nonetheless transferring towards the beforehand introduced separation within the meantime.

“We proceed to make necessary strides to place our enterprise to achieve right now’s evolving media panorama by advancing our strategic initiatives, returning our studios to trade management, and scaling HBO Max globally,” CEO David Zaslav mentioned in a press release. “We took the daring step of making ready to separate the Firm into two distinct, main media firms, Warner Bros. and Discovery International, as a result of we strongly believed this was the perfect path ahead.”

“It is no shock that the numerous worth of our portfolio is receiving elevated recognition by others out there. After receiving curiosity from a number of events, now we have initiated a complete evaluation of strategic alternate options to determine the perfect path ahead to unlock the total worth of our belongings,” he mentioned.

Netflix and Comcast are among the many events, sources informed CNBC’s David Faber.

WBD determined to publicly announce it has had curiosity from a number of events after rejecting a number of totally different bids from Paramount and a proposal from one other firm that was increased than the Paramount bid, in line with an individual acquainted with the matter.

It’s unclear how severe potential provides outdoors of Paramount could be. Netflix was not all for shopping for legacy media belongings, however did not need WBD to go to a different purchaser at a low value, a supply acquainted with the matter mentioned.

Whereas Comcast does really feel the necessity to do a deal, it’s going to have a look at the opportunity of pursuing WBD, sources near the corporate informed CNBC’s Julia Boorstin. Nonetheless, it doesn’t imply Comcast will search a deal.

For any purchaser that simply needs WBD’s studio and streaming belongings, buying them after a cut up later this 12 months is best for tax functions.

Paramount and WBD spokespeople declined to remark. Netflix and Comcast didn’t instantly reply to requests for remark.

WBD has confronted mounting monetary challenges because the 2022 merger of WarnerMedia and Discovery Inc., which saddled the corporate with over $40 billion in debt. It has since undertaken aggressive cost-cutting, restructured its content material pipeline and targeted on worthwhile franchises like “Harry Potter” and “Recreation of Thrones” spinoffs.

Although the corporate has made progress in debt discount, buyers have remained skeptical partly due to the corporate’s cable community portfolio as shoppers transfer towards streaming.