Days earlier than a Louise Nevelson sculpture was scheduled to hit the public sale block at Sotheby’s in Could 2022, one of the crucial highly effective figures within the late artist’s market, Arne Glimcher, declared it inauthentic. Now the consigner is suing Tempo Gallery claiming the reversal was about management.

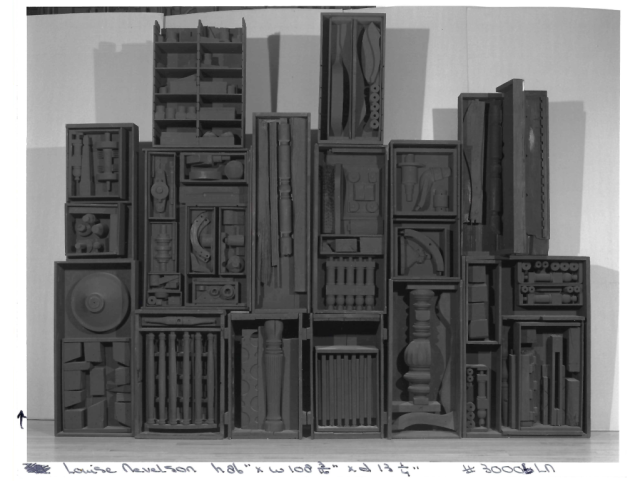

In 1993, Glimcher—founding father of the gallery and Louise Nevelson’s major supplier and shut confidant throughout her lifetime—appraised a stacked-wood wall sculpture attributed to the artist. Almost 30 years later, after the identical work was consigned to Sotheby’s by the property of collector Hardie Beloff, Glimcher informed the public sale home that the sculpture, whereas created from genuine Nevelson packing containers, was assembled by her son, Mike. In response, the Beloff property filed a lawsuit within the US District Courtroom for Japanese Pennsylvania in April of final yr, accusing Tempo of tanking the sale to guard its management over Nevelson’s market.

The core of the Beloff property’s lawsuit is Glimcher’s name to Sotheby’s. In accordance with the criticism, Glimcher informed the public sale home simply earlier than the sculture was set to hit the block that he was “starting the preparation of {the catalogue} raisonné, and I can assure you that this is not going to be in [it].” The 1961 work was given a $500,000 to $700,000 estimate for the Sotheby’s Spring Modern Artwork Day Sale, the criticism says. However after the consignment was confirmed, Maria Nevelson, the artist’s granddaughter and founding father of the Nevelson basis, who had suggested the Beloff property, known as Glimcher to see if the sculpture may very well be included in a spring exhibition in Venice. Within the criticism, the property argues that after Glimcher heard from Maria Nevelson concerning the proposed sale, he “instantly, with none time to analysis or replicate on the Nevelson Wall Sculpture” warned her that it wouldn’t promote and that he would “inform any public sale home to again off.”

Luke Nikas, Tempo’s lawyer, informed ARTnews that the gallery fastidiously thought of the whether or not the work was actually assembled by Louise Nevelson earlier than making its last judgement. The gallery doesn’t dispute the criticism’s description of Glimcher’s name to Sotheby’s.

However the query of the sculpture’s authenticity is sophisticated. In accordance with an appraisal doc hooked up to the criticism, Glimcher personally appraised the work in 1993 as half of a bigger valuation for the Nevelson property. Within the doc, Glimcher assigned it a market worth of $85,000 and described it—together with others within the group—as a sculpture “of mediocre high quality.” In the identical appraisal, he labeled 4 different works as “incomplete,” claiming that they have been merely same-size packing containers stacked for storage. A kind of 4, the criticism alleges, was later bought by Tempo and publicly exhibited as a Louise Nevelson work in 2019, when Tempo described it in exhibition supplies as “placing” with “an absorbing visible complexity marked by fluctuating depths, straight strains and curves, overlaps and vacancies … likened to the faceting of Cubism.”

The Beloff property argues of their criticism that the sudden change in Glimcher’s evaluation of the 1961 sculpture was a part of a broader effort to cement his affect over the Nevelson market and defend Tempo’s place because the artist’s longtime consultant. The Beloff property additionally claims {that a} Tempo workers member informed the property there was no identified catalogue raisonné in improvement.

Nikas refuted that declare, telling ARTnews that the gallery has been compiling paperwork to be used in a list raisoneé for many years and, for about 20 years, has been evaluating works as a part of that preparation course of. Glimcher informed Sotheby’s in the course of the name in 2022 that the gallery was engaged on a list raisoneé.

A transparency of the contested Wall Sculpture given to Hardie Beloff by Mike Nevelson after Beloff bought the work in 1996.

The authorized struggle comes as Nevelson’s legacy is being actively celebrated. Earlier this yr, Tempo mounted the solo exhibition, “Louise Nevelson: Shadow Dance,” curated by Glimcher himself. The present centered on Nevelson’s later works from the Nineteen Seventies and ’80s, a interval through which she embraced diagonals, bolder compositions, and “muscular geometries.” Main institutional exhibits are additionally underway or upcoming on the Centre Pompidou-Metz, the Whitney Museum, the Columbus Museum of Artwork, and Tempo’s Seoul outpost.

The ten years after Nevelson’s dying in 1988 have been marked by property turmoil. One yr after Nevelson’s dying, her longtime assistant, Diana MacKown, and her solely son, Mike Nevelson, turned embroiled in a bitter authorized and private battle. In accordance with the New York Occasions, MacKown claimed possession of three dozen works that she mentioned have been presents from the artist; Mike Nevelson argued they belonged to Sculptotek, an organization he set as much as handle his mom’s affairs. The battle drew consideration from figures like Jasper Johns and Edward Albee, who publicly supported MacKown.

Throughout that very same interval, in response to a current Nevelson biography, the IRS dominated that Sculptotek was a “sham” company and demanded greater than $1 million in again taxes and penalties. Glimcher’s 1993 appraisal was considered one of two made for the IRS on the time. Whereas the case dragged on, Nevelson’s property was unable to promote work, successfully freezing her market. The biography additional states that, when the dispute with the IRS was lastly resolved in 1996, Mike Nevelson refused to deal straight with Glimcher and as a substitute appointed former Tempo vp Jeffrey Hoffeld to supervise gross sales.

Beloff purchased the work in 1996 from Mike Nevelson in his capability because the Nevelson Property, it has mentioned. Two years later, in 1998, Mike Nevelson gave Beloff a doc certifying the sculpture as “a murals by Louise Nevelson and was included within the Property of Louise Nevelson following her dying, April seventeenth, 1988,” in response to the criticism. The sculpture stayed on his wall in Pennsylvania for the subsequent 20 years. Beloff died in January 2022, and quite a few his artworks went to Sotheby’s and have been offered to learn charities, together with a Georg Baselitz sculpture that offered for over $11.2 million, setting a brand new worldwide public sale report for a sculpture by the artist, and the Nevelson work.

As for the Nevelson property, in 2005, almost 20 years after her dying, Mike offered off the property’s remaining stock through sealed bid to a few galleries: Tempo (then known as PaceWildenstein), Gio Marconi Gallery, and Galerie Gmurzynska. It was solely after that sale {that a} marketplace for her work may very well be reformed. Her public sale report of $1.4 million was set in 2021 at Christies.

The present lawsuit hinges on how a lot affect Glimcher ought to nonetheless wield over Nevelson’s posthumous popularity.

Representing an property boils down to 2 targets: promoting stock and preserving legacy. Estates and galleries usually agree on clear requirements for works that fall into grey areas of attribution, which is frequent after an artist dies. As one supplier with expertise managing estates informed ARTnews, “Crucial component is consistency. You may’t be transferring the goalposts.”

The Beloff property claims that’s precisely what occurred. The criticism alleges that when the work was listed by Sotheby’s, Glimcher reversed a decades-old appraisal with out providing new proof—and did so with sufficient authority persuade Sotheby’s to tug the lot.

In February, a US District Courtroom decide dismissed many of the Beloff property’s claims, together with one which alleged that by killing the Sotheby’s sale Tempo successfully made the work unsellable to different events which may have been , calling that declare too speculative. However one key declare stays: that Tempo improperly interfered with the Beloff property’s consignment settlement with Sotheby’s by saying the work wouldn’t seem within the catalogue raisonné.

That a part of the case now strikes ahead, with the Beloff property searching for over $1 million in damages. In a movement to compel the manufacturing of paperwork filed final month, the plaintiffs additionally accused Tempo of stonewalling discovery by limiting doc manufacturing to supplies associated solely to the purported catalogue raisonné. They’re searching for a lot, a lot broader information, together with all communications between the gallery and Hoffeld and Mike Nevelson, to assist their declare that Glimcher’s feedback have been a bad-faith effort to derail the sale.

“This meritless case rests on allegations of a disgruntled collector, who’s making an attempt to bully Tempo Gallery into authenticating an art work that was not accomplished by Louise Nevelson,” Nikas informed ARTnews in an e mail. “The Courtroom has already dismissed each declare however one, and we have now paperwork to show it’s false.”

Richard L. Bazelon, one of many plaintiffs and co-executors of the Beloff property, declined to remark. “I typically don’t touch upon litigation through which I’m concerned,” he wrote in an e mail to ARTnews. “The operative info within the case in Plaintiff’s view are set forth within the Grievance.”

Public sale homes like Sotheby’s typically face troublesome choices when authenticity is disputed—particularly when considerations come from somebody with deep authority. “At that time, the public sale home is basically a impartial stakeholder,” Mari-Claudia Jiménez, an lawyer and former head of enterprise improvement at Sotheby’s, informed ARTnews. “They might simply return the work to the consumer and say, ‘We aren’t going to promote this. Take it again and have a pleasant day.’”

Within the US, in response to artwork lawyer Judd Grossman, who just isn’t concerned within the case, the appraisal of an art work is taken into account separate from its authentication. “Our courts have made clear that an appraisal is an opinion of worth, not of authenticity,” Grossman informed ARTnews.

And as New York–primarily based adviser David Shapiro, an authorized member of the Appraisers Affiliation of America, put it, “An appraiser’s job is to replicate what’s taking place available in the market. If we predict a piece wouldn’t be perceived as genuine, that should issue into the worth. And if new info emerges, an appraiser can change their thoughts—as long as it’s disclosed.”

However what occurs when the gatekeeper to an artist’s legacy can also be their greatest supplier? That’s the query this lawsuit refuses to let die.

Lawyer Thomas C. Danziger who, whereas uninvolved with the case, has years of authorized expertise round authenticity points in artwork transactions, informed ARTnews that he has seen an skilled’s opinions concerning authenticity change over time: “Generally extra info involves gentle, and generally individuals simply rethink opinions given at an earlier date.” He added that, “Sadly, regardless of the deserves of the claims within the Tempo case, litigation like this does have a chilling impact on consultants’ willingness to stay their necks out and provides their opinions. And that’s not good for the artwork market.”

The sculpture stays in storage in Philadelphia. A trial date has not but been set.