Elon Musk’s cut-first, aim-later run via the federal authorities relies on the concept the nation’s funds are in disaster and that it must drastically reduce spending to get better. However no less than one reduce Musk’s crew is planning will really value the federal government cash, worsening the supposed fiscal disaster that the Trump administration is claiming is a nationwide emergency.

That’s Musk’s plan to chop jobs on the US Inner Income Service.

On the behest of Musk’s Division of Authorities Effectivity crew, the IRS reportedly plans to put off as much as 6,700 workers, and the cull started final Thursday. These affected embrace over 5,000 staff dealing with auditing and collections, regardless of assurances from IRS managers that positions important to tax submitting season haven’t been impacted. Lots of them are probationary workers who’ve been working for the federal authorities for lower than a 12 months and aren’t entitled to severance.

So how are these cuts going to value cash?

It seems that cash spent on IRS brokers pays for itself many instances over, as a result of when there are extra folks doing tax enforcement, the federal government takes in additional of the income it’s legally owed beneath the tax code.

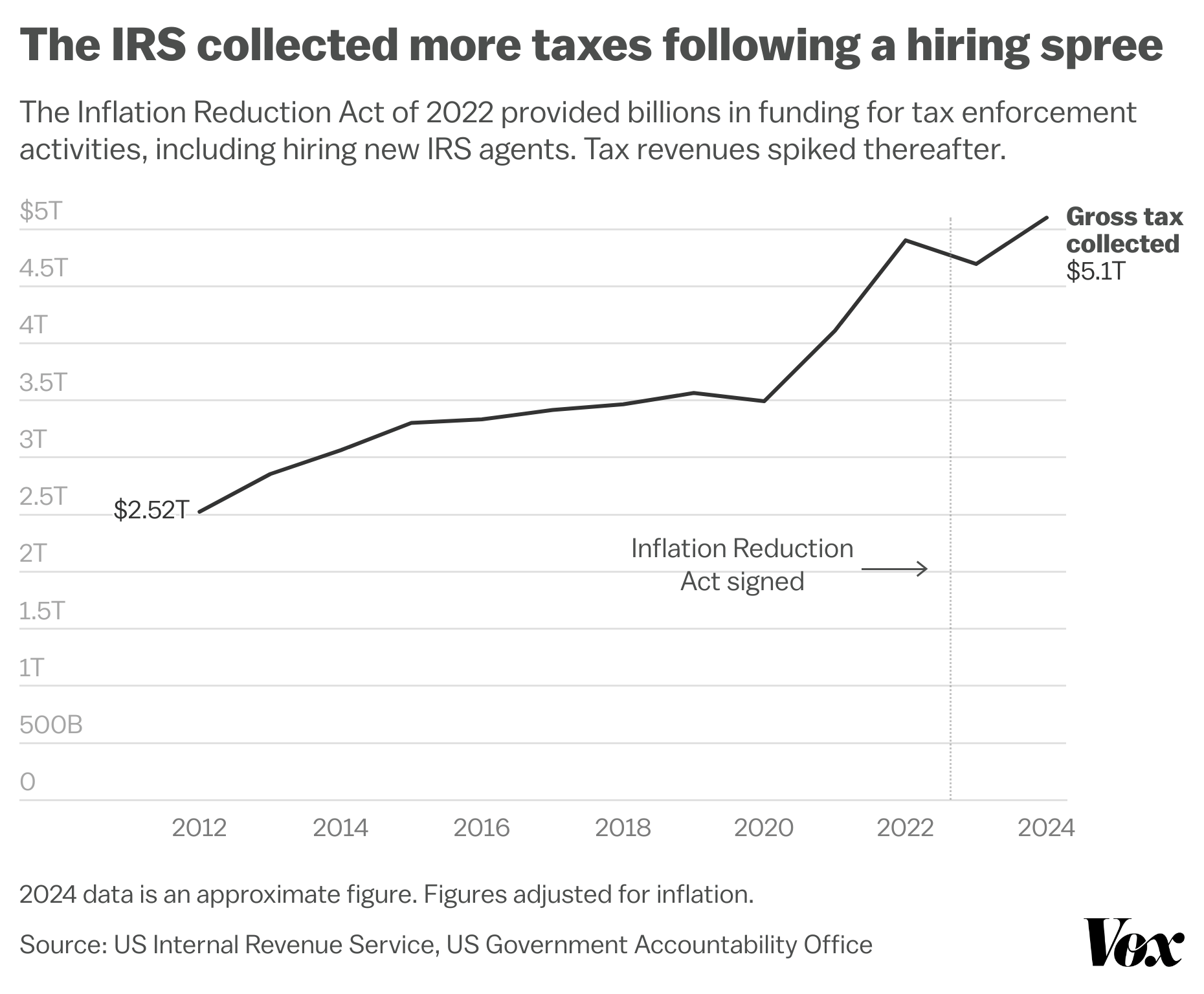

The Biden administration confirmed that investing within the US Inner Income Service is usually a boon to tax revenues, hiring new brokers — and focusing enforcement on the very best earners.

The layoffs may solely be the start: Trump has additionally proposed the creation of an “Exterior Income Service” funded by tariffs, reportedly with the intention of changing the IRS. It sounds far-fetched, and Trump famously floats loads of excessive concepts that by no means come to fruition. However any additional important discount within the IRS workforce, nonetheless, might result in a corresponding decline in tax collections — particularly among the many wealthiest People who’ve not too long ago been focused for tax enforcement.

The IRS bought extra sources and better tax revenues adopted

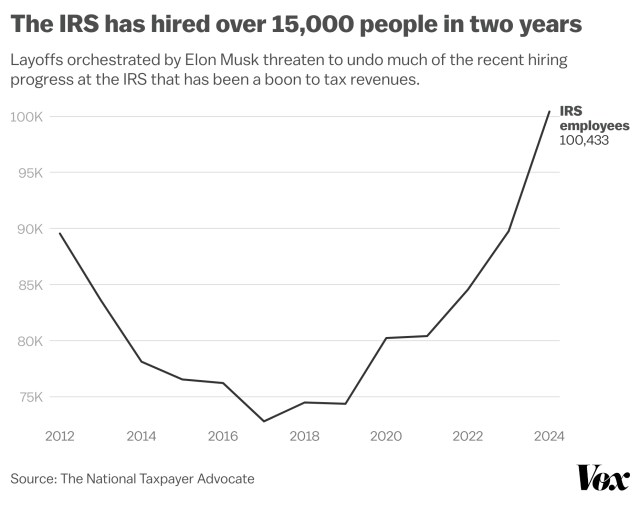

In mid-2022, President Joe Biden signed the Inflation Discount Act, which included an $80 billion funding over ten years in tax enforcement actions on the IRS, together with the hiring of extra IRS brokers. Within the two years that adopted, the company’s workforce grew by greater than 15,000 everlasting workers.

A giant spike in tax revenues adopted, with gross collections leaping from $4.7 trillion in fiscal 12 months 2023 to about $5.1 trillion the subsequent 12 months, in line with information from the IRS and the Nationwide Taxpayer Advocate.

Clearly, there are loads of elements that contribute to tax income ranges, together with, most significantly, the state and measurement of the economic system in a given 12 months. However within the 2023-2024 leap,

a lot of the rise got here from enforcement actions in opposition to folks making over $400,000 per 12 months, in line with a report from the Authorities Accountability Workplace. That implies that stepped-up IRS enforcement performed a distinguished position.

The company collected about $1.1 billion from simply 1,600 of these wealthiest People with unpaid tax money owed in fiscal 12 months 2024, up from $38 million the 12 months earlier than. That cash was solely recovered as a result of the IRS lastly had the required staffing ranges to research, serving to to make some progress in closing an estimated $696 billion hole in unpaid US taxes.

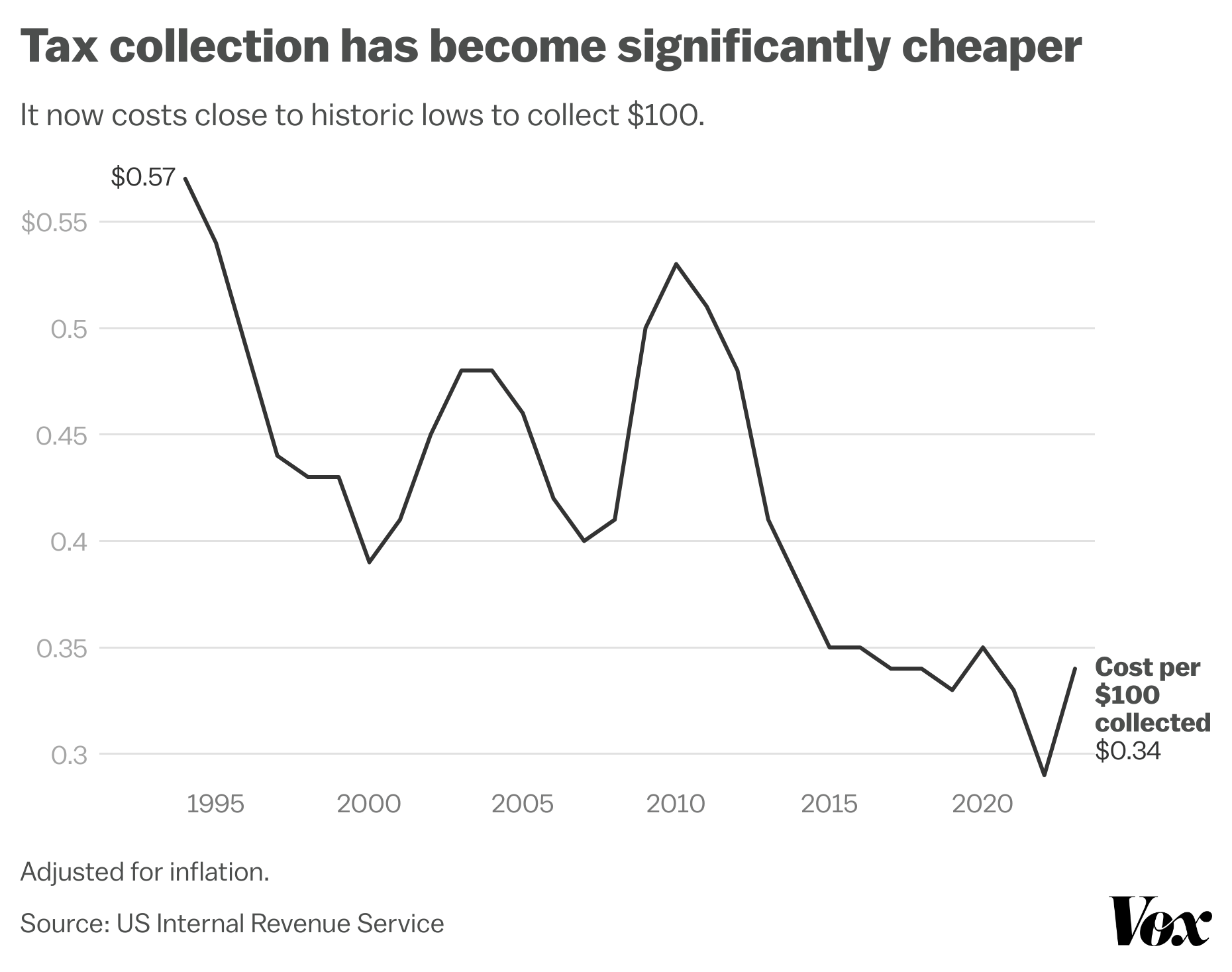

Regardless of important boosting funding for the IRS, the prices of tax assortment have really gone down in recent times. For each $100 collected, the IRS solely spent 34 cents in fiscal 12 months 2023, close to historic lows.

None of that has proved sufficient for the Trump administration to avoid wasting the roles of the 1000’s of IRS staff now dealing with layoffs. Decreasing the IRS workforce at a time when revenues and effectivity have been growing might finally backfire, exacerbating the alleged monetary disaster that Musk purports to need to remedy.