It’s not simply the inventory market.

Within the few weeks since President Donald Trump introduced sweeping tariffs, a collection of indicators from throughout the financial system recommend anxiousness — and even outright panic — is within the financial driver’s seat.

Shopper confidence is at a near-record low. Individuals are panic-buying merchandise which can be prone to see main worth hikes quickly, from automobiles to shopper electronics. Companies are additionally already predicting a slowdown in manufacturing, suggesting that Trump’s tariffs are literally working towards his acknowledged — and sure inconceivable — purpose of reviving American manufacturing.

This has an actual affect on the well being of the US financial system. Assured customers spend and help assured companies, which gasoline financial progress and rent employees. Trump can’t obtain his targets of onshoring manufacturing and ushering in a golden period of American prosperity when each customers and companies are spooked.

It may be too early to inform whether or not Trump’s tariffs will result in a recession, however it’s clear that they’re already shifting financial exercise within the US. Right here’s what the info present.

Shoppers are buying scared

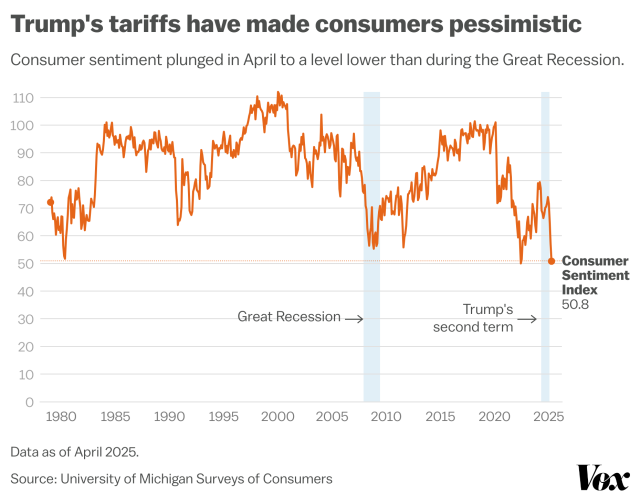

The main metric of shopper confidence is the College of Michigan’s shopper confidence index, which measures how favorable People really feel concerning the financial system primarily based on their responses to a collection of survey questions.

That index plunged instantly after Trump’s tariffs, all the way down to 50.9 — decrease than through the Nice Recession and near the historic low within the interval following the Covid-19 pandemic.

This implies that Trump’s tariffs are usually not simply sending shockwaves by the inventory market, but additionally the pocketbooks of on a regular basis People, who had been already combating the aftermath of excessive inflation.

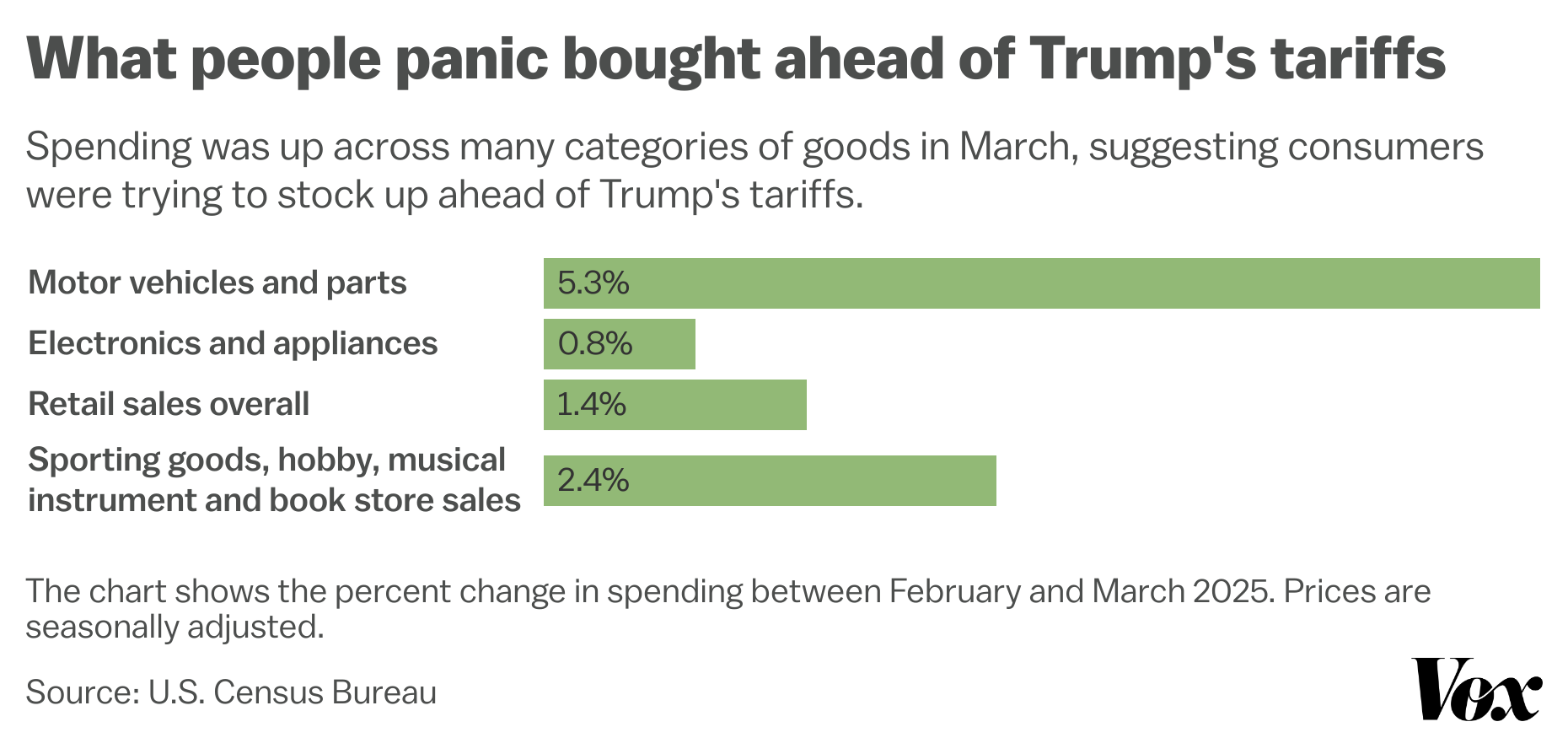

Economists anticipate that customers will finally pull again on spending in consequence. However within the quick time period, they seem like stocking up. However economists say the spike in sure spending is neither sustainable nor proof of a wholesome financial system.

“Whenever you announce you’re doing tariffs in two weeks, that’s going to result in an enormous decline in spending in two weeks, however it could result in a very massive enhance in spending within the quick time period,” mentioned Michael Madowitz, principal economist on the Roosevelt Institute, a progressive financial suppose tank. “I purchased a bunch of components to repair my actually previous automobile.”

He’s not the one one: In March, motorized vehicle and components sellers noticed a 5.3 % enhance in gross sales from the earlier month and an 8.8 % rise from the identical month final 12 months. Trump had, at that time, introduced 25 % tariffs on totally assembled vehicles, scheduled to take impact by Could 3.

In March, electronics and equipment shops additionally noticed a 0.8 % enhance from February and a 1.8 % enhance from the identical month final 12 months. China is likely one of the world’s largest producers of shopper electronics, and Trump had been speaking about hitting it with tariffs for months at that time.

Trump has since supplied a restricted exception for shopper electronics from his baseline 145 % tariff on Chinese language imports, however it’s not clear how a lot that may insulate these merchandise from worth hikes. Trump has additionally mentioned that shopper electronics might face extra, yet-to-be-announced tariffs on merchandise that include semiconductors.

American manufacturing is in hassle

Trump has promised that “jobs and factories will come roaring again into our nation” on account of his tariffs. His hope is that, in making it dearer to import international items, corporations will search to spend money on bringing their manufacturing to the US, subsequently bringing costs down for American customers in the long term. He additionally claims that the tariffs will cease different international locations from “dishonest” America with commerce imbalances.

Nevertheless, economists had been skeptical of these claims from the outset. The Economist referred to as the tariffs the “most profound, dangerous and pointless financial error within the trendy period,” primarily based on an “totally deluded” understanding of economics and historical past.

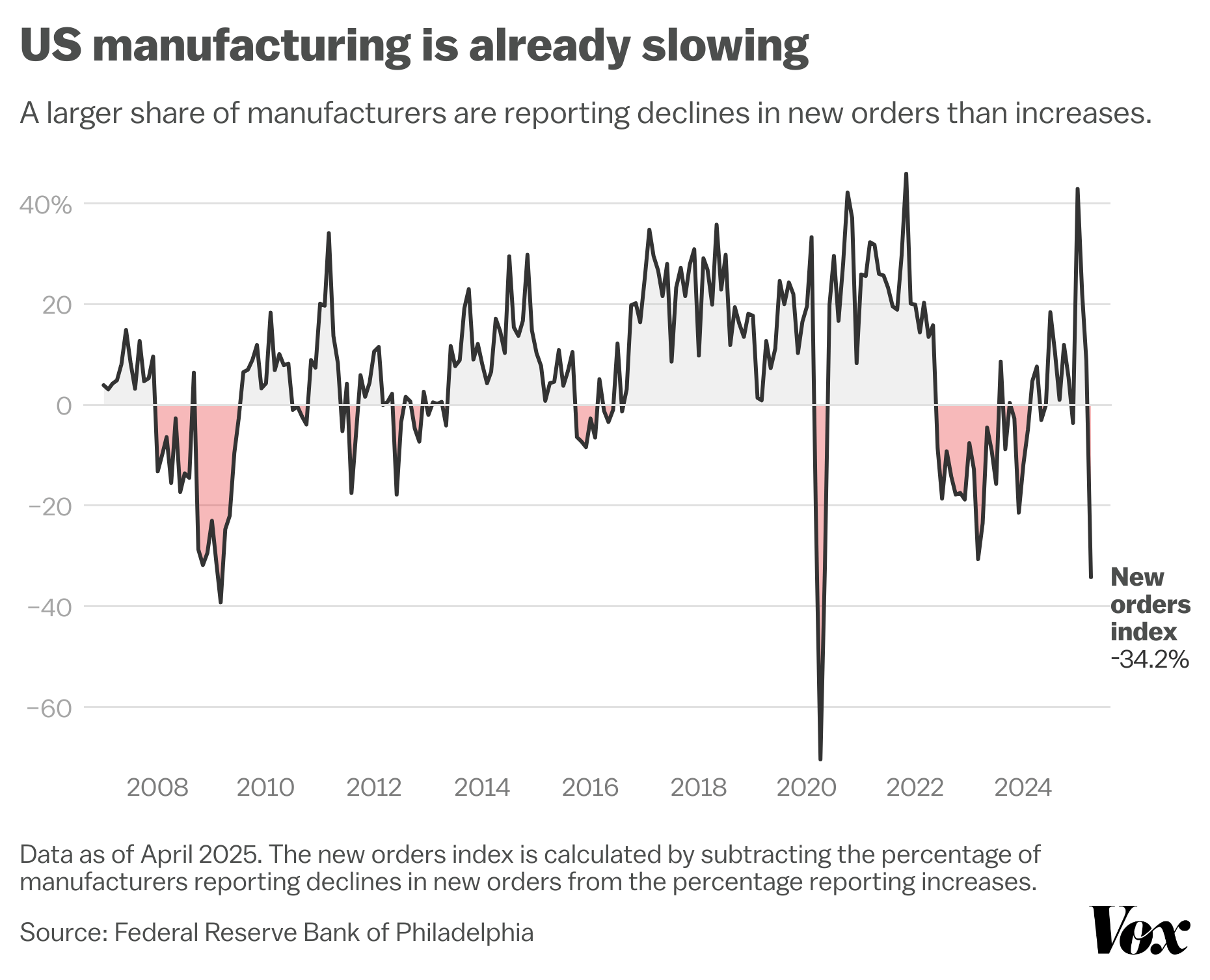

Now, the info reveals that Trump’s tariffs are having the alternative of their meant impact: US manufacturing has slowed within the weeks since he made the announcement, and economists anticipate that development to proceed.

Surveys of American producers performed by the Federal Reserve Banks of New York and Philadelphia revealed a pessimistic outlook. Each expectations for normal enterprise exercise and for brand new product orders declined sharply in April.

The New York Fed’s future normal enterprise situations index dropped from 12.7 in March to 7.4 this month, its second-lowest studying in additional than twenty years. The Philadelphia Fed’s new order index dropped from 8.7 in March to -34.2 this month, its lowest studying since April 2020, simply after the pandemic started.

That’s dangerous information for the companies that Trump mentioned would profit from his tariff insurance policies, however are actually struggling to plan for the months and years forward in an setting of such uncertainty. In an effort to persuade him to desert the tariffs, some American producers have averted criticizing them straight and as a substitute sought to advertise how a lot they’re already investing closely of their US factories.

However it’s not clear that even overtures from American manufacturing leaders and panic amongst customers will persuade Trump to surrender his decades-long obsession with tariffs as an answer to what he perceives as international commerce obstacles.